Debt mutual fund investors can never forget the events that happened in April 2020.

Franklin Templeton, one of the largest debt fund managers in the country announced winding up of its 6 debt funds. A wind up at a scale unseen in the industry before. The 6 debt funds had assets of over INR 25,000 crores!! This event shook investors’ belief in debt mutual funds, particularly credit risk funds. But the whole saga was not an overnight event. It was long in the making.

If you would like to watch our video on this subject, then you can watch it here:

2015 onwards we have seen many high-profile defaults. I have listed 10 of them below.

-

ADAG Group

-

Altico

-

Amtek Auto

-

Ballarpur Industries

-

Café Coffee day

-

DHFL

-

Essel Group

-

IL&FS

-

Sintex

-

Yes Bank

So it had been clear for some time that there is something wrong with India credit story. But it would be a while before all the skeletons tumbled out of the cupboard.

From 2016 onwards the wound-up Franklin Templeton funds had close to 80% exposure to bonds rated AA or below. To set things in perspective, IL&FS used to have a rating of AAA and then its default shook up the industry. Further the liquidity risk is high in bonds with rating below AA . So, if things were to go wrong then a fund manager would struggle to exit to meet redemption pressure.

But investors ignored the fundamentals. Credit risk and liquidity risk were considered as risks that exist only on paper. Investors either under estimated the risks or thought the big fund managers will figure a way out. It was history repeating for investors who thought like this. Because this is not the first time a big name has gone under. History is replete with such examples.

Today we can say most of the pain is behind us. But it would be a shame if we don’t learn some valuable lessons from this whole saga.

In this article I have listed 5 lessons which I have taken away from what I call the credit market tragedy.

1. Stick to safe fund houses

When I analyzed these 10 defaults, I found something interesting. Out of the 30+ fund houses, IDFC, HDFC & Axis have the least exposure to these 10 defaults. So in some way I would like to believe their risk management culture to be superior to other mutual fund houses. Otherwise, how do you consistently have saves.

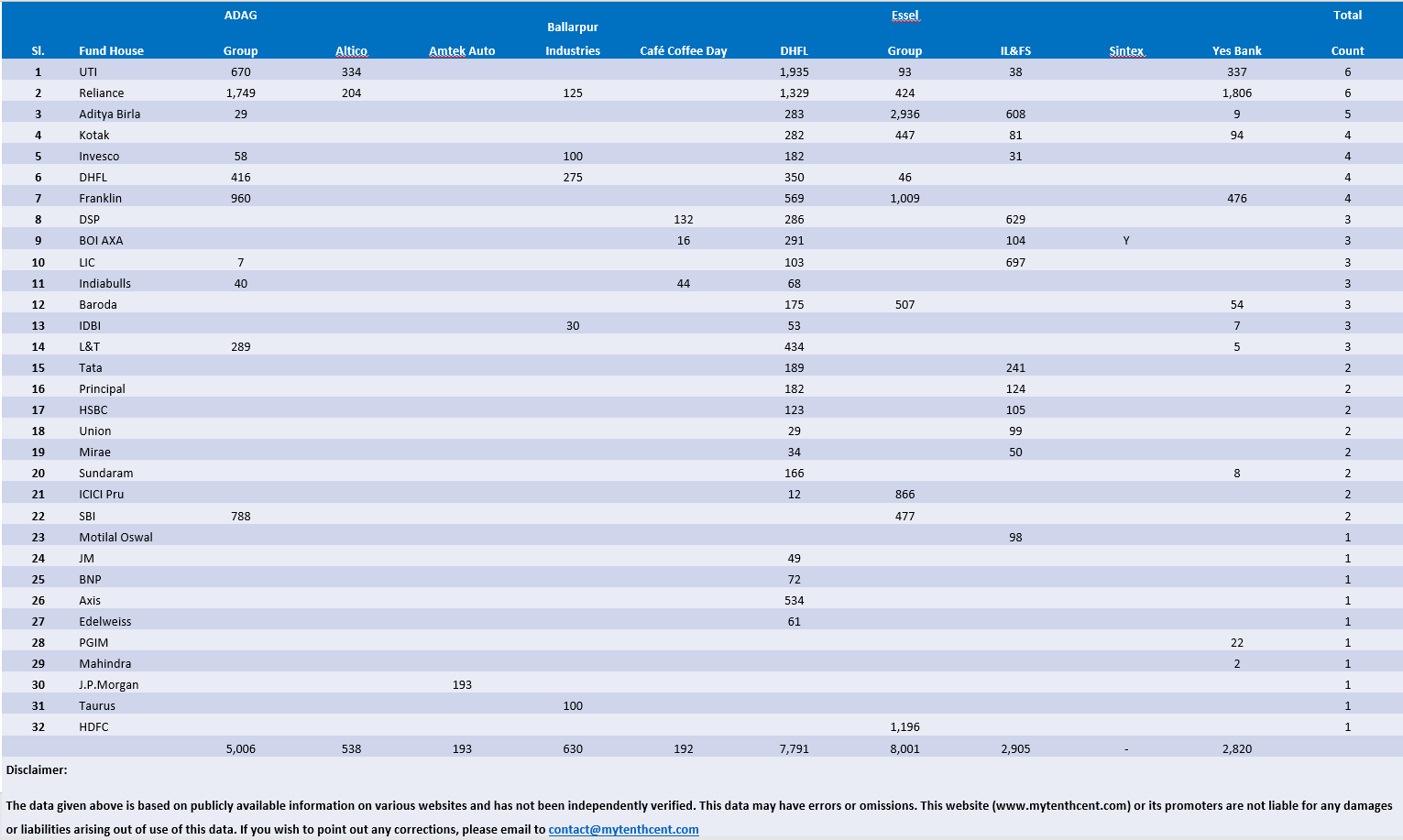

UTI, Reliance, Aditya Birla, Invesco, DHFL & Franklin have got caught on many of these defaults. UTI Mutual fund & Reliance Mutual Fund are present in 6 out of these 10 cases. A detailed table showing mutual fund exposure across these 10 cases has been given in below.

So I would rate IDFC, HDFC and Axis a notch above the rest. ICICI & SBI not too far behind.

2. Don’t chase returns

When it comes to investment in debt mutual funds, don’t chase returns. I am not saying returns are not important. But don’t invest based on returns alone. Don’t pick the chart topping funds. That extra 1% return could be coming at the cost of going down the credit risk chain or taking a larger interest rate risk. Our bankruptcy laws and proceedings take a lot of time. So when credit calls go wrong its not easy to recover money. Unfortunately, people don’t realize this. Because most of the time focus is on chart toping funds based on returns.

We should also remember that debt mutual funds is for our safer investments. Equity mutual funds are for taking risk. So, play safe in debt mutual funds and take risk with your equity mutual funds.

So, focus on fund houses with a good track record of managing risks as given above. The defaults that have happened have separated the men from the boys.

In these fund houses, focus on funds with AAA portfolio. In India even AA is not high quality especially when AAA can also deteriorate in a short time. Case in point being IL&FS default. This could mean 1% – 2% lower returns but by design much of the debt portfolio is supposed to focus on safety.

Further as mentioned earlier, safety is also important due to liquidity risks. When credit calls go wrong there is a risk of a Franklin Templeton saga repeating all over. Then it is not just about returns. Your entire investment can get stuck. So, it is better to have lower returns on debt mutual funds. We can make up for the short fall by adding equity mutual funds to the portfolio. We focus on asset allocation to achieve our targeted returns instead of adding riskier debt mutual funds to the portfolio.

3. Stick to fund schemes with a reasonable size

I would steer clear of investing in mutual fund schemes with a small corpus. The larger the debt mutual fund scheme the better the ability to absorb losses.

In equity mutual funds a fund manager is normally able to sell stocks when his view changes. At least large cap mutual funds are able to exit positions when fund manager’s view changes. There is a very wide and large investor base. But in debt mutual funds that is not the case.

In the debt mutual fund space, when a credit goes down, the fund manager often struggles to sell the bond. Why? Because the corporate bond market in India is still nascent. Most of the bond market liquidity is towards less than 1 year bucket and government bonds. So often when a corporate credit worsens there is often no buyer for the risk.

You may be wondering so what? Why can’t the fund manager just wait for the recovery proceedings and recover money later. Well it doesn’t work that way. The legal proceedings take a long time and often recovery is a question mark.

When defaults become public, investors may want to redeem their investments in that mutual fund scheme. Since fund manager can’t sell the bad bonds, the fund manager ends up selling the good bonds to meet redemption. As a result the residual portfolio becomes even worse. This triggers more redemption. The cycle leads to very poor outcome for the scheme or even shut down as in the case of Franklin Templeton.

But if the mutual fund scheme is very large, then a INR 100-200 crore default won’t really move the needle. The fund manager should be able to meet any resultant redemption pressure. But if the mutual fund scheme is small then it can be a downhill quickly from there.

So, focus on large debt funds. Bigger the better.

4. Don’t concentrate your investments

Do not concentrate your investments into 1 or 2 debt mutual fund schemes. As outlined above if things go wrong, there is a risk of shutdown of the mutual fund scheme. So your entire investment can get stuck.

One way to mitigate this risk is to invest in large funds. The second way is to spread your investment across 5 to 6 funds by investing not more than 15 – 20% of the corpus in one fund. So, the worst-case scenario does not impact more than 15-20% of your portfolio.

This diversification will not make a material difference to your portfolio returns. This is because most of the debt mutual funds fall in a narrow range in returns. In equity mutual funds, the difference in returns between funds can be 10% or more. In the case of debt mutual funds, the difference in returns between most of the funds is usually in the 2.5% range.

So, invest in a single fund to extent you are comfortable.

5. Don’t panic or shy away from investing in debt mutual funds.

I know investors who shy away from investing in debt mutual funds today. They have read about the defaults and about Franklin Templeton. Being concerned they stick to fixed deposits. This is an extreme move to my mind.

Fixed Deposit have a place in your Asset Allocation, so does debt mutual funds. On a like to like basis debt mutual funds are a notch better than fixed deposits. This is on the basis of returns, tax advantage & ease of redemption.

Yes, there have been many defaults as I have outlined above. But these defaults are still a fraction of the funds outstanding under debt mutual funds. The 10 defaults I mentioned above are ~INR 28,000 crores which is ~2-3% of the INR 11.5 lakh crores or so under debt mutual funds.

On a standalone basis, these defaults are big and have led to serious issues with some debt mutual fund schemes. But on an overall basis its still a very small amount. So, it should be okay even if the fund you invest in has to take a loss once in a while. When you invest on a long-term basis a quarter or two of lower returns is not going to hurt you. You just need to watch out for situations such as Franklin Templeton saga. So, over a 7 to 10 year horizon, these defaults should not make any material impact on your portfolio. This is especially if you take into consideration the 4 learnings highlighted above.

Over, it’s important to have debt mutual funds in your portfolio.

Conclusion

There would be further articles on many of the debt default cases listed here. What happened and valuable lessons. You can subscribe to receive these stories directly into your inbox.

I hope this article has given you a fresh perspective on debt mutual fund investment. There is a 3-part series on “All you need to know about debt mutual funds” on this website which may also interest you. Do check it out.