Fixed Deposits or FDs as they are called, are the simplest of all investment products. It is the first financial product that we learn about. Growing up we would have all seen our parents and grandparents talk about Fixed Deposits and Recurring Fixed Deposits. The first advice that I got when I started my first job was to open a Recurring Fixed Deposit. Every month to put away some money in Recurring Fixed Deposits. I remember my parents making diligent trip to the banks for updating the pass book or renewing the fixed deposits. So Fixed Deposits have been and are the only form of savings for many families.

For the uninitiated, Fixed Deposits are an investment product offered by banks and NBFCs. NBFC stands for Non Bank Financial Companies; Muthoot Finance Ltd. for example. You open a fixed deposit account with a bank for a per-defined interest rate and duration. Interest Rates offered by the banks depend on the duration. For example, SBI offers 5.0% per year interest rate for a 1-to-2-year duration. You can choose to have interest credited to your account on a regular basis or have it accumulated till the end of the duration. You also have the option of taking a loan against the fixed deposits if you urgently need some money. So, it is a great product for investment if you are looking at maximum safety of your money.

Now, in this article I will focus on the 3 most important aspects about fixed deposits that every investor must know.

1. What happens to your fixed deposits if the bank goes bankrupt?

In case you are wondering, the banks where you park your money can get into trouble. Punjab & Maharashtra Co-operative Bank, Yes Bank, Lakshmi Vilas Bank, Madhavpura Mercantile Co-operative Bank etc. are all examples where the banks went into bankruptcy or liquidity problems.

Since fixed deposits are the most common form of savings, Government has put in place some protection. There is Deposit and Credit Guarantee Corporation (DGCC) which insures the deposits you keep in a bank. DGCC will cover up to INR 5 lakhs of principal and interest, if your bank goes bankrupt. Anything over and above is at your own risk.

This is Rs. 5 lakhs of your money kept in all formats with one bank i.e., savings account, fixed deposits, current accounts, recurring deposits and interest on these types of deposits.

For example, if you have a Rs. 5 lakhs fixed deposit and the bank goes under. Then DGCC will pay you Rs.5 lakhs. But DGCC will not cover the unpaid interest on the Rs. 5 lakhs deposit; as the cap of DGCC cover is Rs. 5 lakhs. Now instead of Rs. 5 lakhs, if the fixed deposit was for Rs. 4 lakhs and let us assume you have unpaid interest of Rs. 50,000 on this fixed deposit. Then DGCC would cover Rs. 4.5 lakhs i.e., Rs. 4 lakhs of fixed deposit and Rs. 50,000 of interest on this deposit; as Rs. 4.5 lakhs are within the Rs. 5 lakhs DGCC cover. So also, if you have accounts in two different banks, then you will get insurance cover up to 10 lakhs i.e., 5 lakhs for each of the banks. But if you have different accounts in the same bank, then the cover would be Rs. 5 lakhs only. The Rs. 5 lakhs limit is a on per customer per bank basis. So, all your accounts with one bank would be aggregated and considered as one single account for the purpose of DGCC cover.

2. Are fixed deposits the safest & best way to keep your money?

Yes, they are the safest; at least up to Rs. 5 lakhs. But fixed deposits are not the best way to invest your money. Fixed deposits have amongst the lowest returns across all investment categories. Fixed Deposits are also inefficient from income tax perspective.

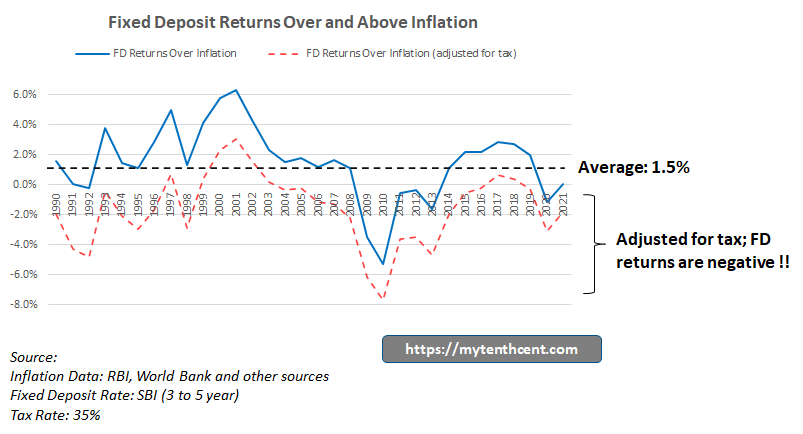

As per historic data, Fixed Deposits have given the least returns over inflation; around 1 to 1.5% p.a. over inflation.

Further, on the interest earned from fixed deposits you need to pay income tax as per your tax slab. So, if you are in the higher or highest tax bracket, your income tax rate could be as high as 35% to 40%. So, once you adjust for income tax the returns are abysmal. In fact, at the higher tax slabs, you can expect returns to dip well below inflation rate.

3. How much wealth should you keep in fixed deposits?

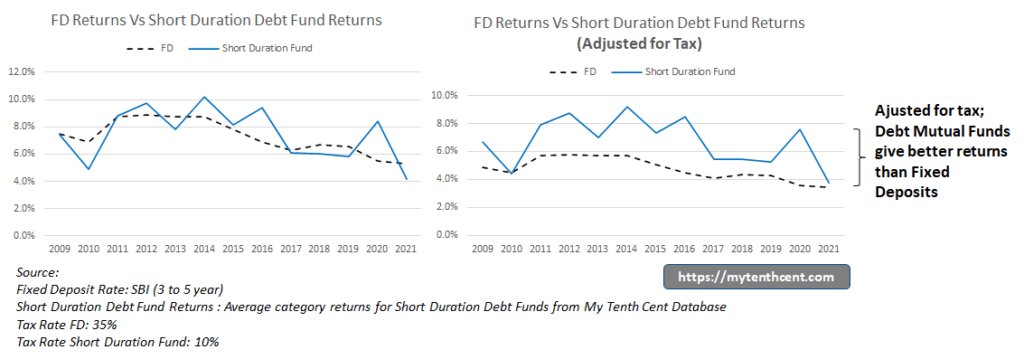

As mentioned above fixed deposits suffer from low returns especially adjusted for income tax. Debt mutual funds are a better option. Historically, Debt Mutual Funds have given nearly same returns as Fixed Deposits. But on a tax adjusted basis Debt Mutual Funds outrank Fixed Deposits.

On the income tax front, you have to pay income tax only when you sell the debt mutual fund units. And if you have invested for more than 3 years, you get indexation benefit. Once you take into account indexation benefit, the effective tax rate drops down to single digit i.e., 10% or lower. In comparison on fixed deposits your income tax rate applicable can go up to 35 to 40% depending on which income tax slab you fall under.

To understand more about indexation benefit, you can read through this ET Money article.

However, debt mutual funds do not benefit from DGCC cover. But you have plenty of debt mutual fund options which are very close to fixed deposits in safety. You can read our Debt Mutual Fund articles on how to pick the right debt mutual fund or watch our YouTube video on this subject.

Takeaways

So, review your portfolio of fixed deposits. If you have large sums of money in the form of fixed deposits in Co-Operative Banks, beware. Keep fixed deposits more than Rs. 5 lakhs only with the large Public Sector or Private Sector banks.

And overall use fixed deposits for near term goals up to 1 year. For longer term use debt mutual funds. And of course, for wealth multiplication use equity mutual funds.