Are you confused on which debt mutual fund to invest in? Debt mutual fund portfolio in India is around 11.5 lakh crores. There are 16 types of debt mutual funds and over 300 debt fund schemes to invest in. So, it is natural to wonder which fund to invest in? This article should help you figure an answer to this question.

I have published a detailed ‘Debt Mutual Funds – All You Need to Know’ 3-part series on this website. This series gives a comprehensive overview of debt mutual funds. In Part 1,I have covered some of the nuances of debt mutual funds. In Part 2, I have classified the debt mutual funds into 3 categories. And finally, in Part 3,there are some good guidelines and strategies for investing debt mutual funds. You should read these in case you haven’t done so already .

As covered in Part 2 of the above series, Category 2 type of debt mutual funds is reasonably sufficient when it comes to debt mutual funds.

You can also watch our video on “4 Tips to Choose the Right Debt Mutual Fund”

Good Category 2 funds:

Category 2 consists of Short Duration Funds, Corporate Bond Funds and Banking & PSU Funds. A quick recap given below:

-

Short Duration Fund: Invest in bonds of any credit rating subject to duration being one to three years

-

Corporate Bond Fund: Invest at least 80% in bonds with highest rating (AAA)

-

Banking & PSU Funds: Invest at least 80% in bonds of Banks, Public Sector Undertakings or Financial Institutions. This is generally the safer category considering Government ownership.

Now within Category 2 we apply some more strategies to help us pick the right funds.

-

We stick to safe fund houses. These are fund houses which have established a robust track record in managing risk. I have covered this in detail in the article 5 lessons from defaults for debt mutual fund investors. IDFC, Axis, HDFC, ICICI & SBI amongst the large fund houses have done a good job in navigating the credit crisis

-

Amongst these fund houses, we choose large mutual fund schemes. The larger the better. This is because large funds have higher ability to absorb losses. This is to also ensure a Franklin Templeton saga doesn’t repeat in our portfolio.

-

We don’t chase returns. We do not just pick the scheme with highest return. We also pay attention to their portfolio. We pick schemes with most AAA allocation.

-

Last, we don’t concentrate our investments. We pick 5 to 6 mutual fund schemes. This is to ensure not more than 15% to 20% of our investment is in one scheme.

So, I have shortlisted below a few good funds applying these criteria on Category 2. You may also notice a few aspects about the shortlisted schemes:

-

All are large schemes with size ranging from around 10,000 crores to close to 27,000 crores.

-

Performance of each of these funds have been similar to the rest of the pack. So, you can build a portfolio of 6-8 schemes out of these 14 schemes. It should not matter much which fund you pick.

-

The below data is for Regular plans. If you choose to invest in Direct plans, then your returns would be higher by 0.5%p.a. or so.

Good Category 3 funds:

As I have said before, Category 2 funds should be quite enough in your debt portfolio. Over the last 10 years, these funds on an average have given 8 to 8.5% per year returns. Category 3 funds would have given another 1 to 1.5% per year higher return.

But Category 3 funds are for sophisticated investors. The funds in Bucket 3 undertake reasonable credit risk or interest rate risk or both. For example, in Gilt funds, there have been years when some of the funds have given 25 to 30% returns. Likewise in some years losing in double digits as well. Hence you need to have a good understanding of this space.

Before we move further, a quick recap of Category 3 funds. Category 3 funds include the following categories:

-

Medium Duration

-

Medium to Long Duration

-

Long Duration

-

Gilt Fund

-

Gilt Fund with 10-year constant duration

-

Dynamic Fund

-

Credit Risk Fund

-

Floater Fund

If you have higher risk appetite then you can consider 25-30% of your debt portfolio allocated to Category 3 funds. But this should be long term money. Now, Category 3 has 8 sub-categories. Out of these you can focus on Dynamic Funds. If you wish you can also consider some Gilt Funds and Credit Risk Funds (from the safe fund houses). You don’t need to extend beyond these 3 categories.

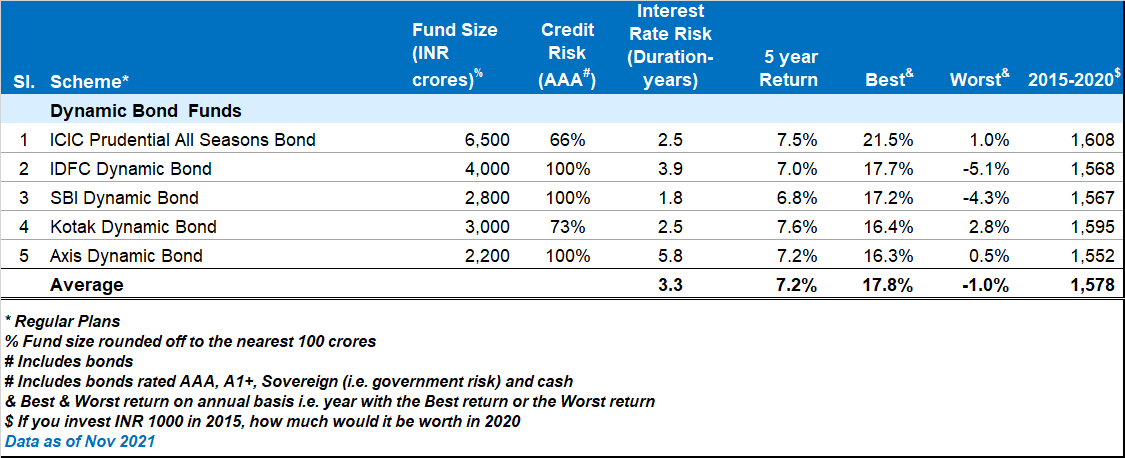

In Dynamic Funds the fund manager has full flexibility. The fund manager can travel across credit risk and interest rate risk. So, you go by fund manager track record. Basis the strategies given earlier; I have picked 4 Dynamic Bond schemes with a proven track record. ICICI Prudential All Seasons Bond stands tall amongst the pack.

Good Category 1 funds:

Finally good Category 1 funds. Category 1 being the following categories:

-

Overnight (1 day)

-

Liquid (up to 91 days)

-

Ultra Short Duration (3 to 6 months)

-

Low Duration (6 to 12 months)

-

Money Market (up to 1 year)

Category 1 funds are essentially short term funds. They can invest only in bonds with duration of up to 1 year. The 5 funds above differ from each other on the period of the underlying investments. The period of investment, these funds can make is given in the bracket above.

If you have read Part 2 of the debt mutual fund series on this website, you would notice that fixed deposits are a better alternative to Category 1 funds for individual investors. Fixed Deposits are almost 100% safe provided you invest with the right banks. But in Category 1, except overnight funds, the rest of the categories do take credit risk. Many Liquid funds and Ultra Short duration funds have got hit with credit defaults in the past.

Now there could be certain situations where you still need to invest in Category 1 funds. COVID has thrown up a few of such situations. For example, you want to buy a property or repay home loan. You have the funds kept aside but you are not able to predict when you will be able to use it. In this case getting into a fixed deposit and breaking it later can be a hassle. In such situations you can invest in Category 1 funds.

But the question is which category amongst the above 5?

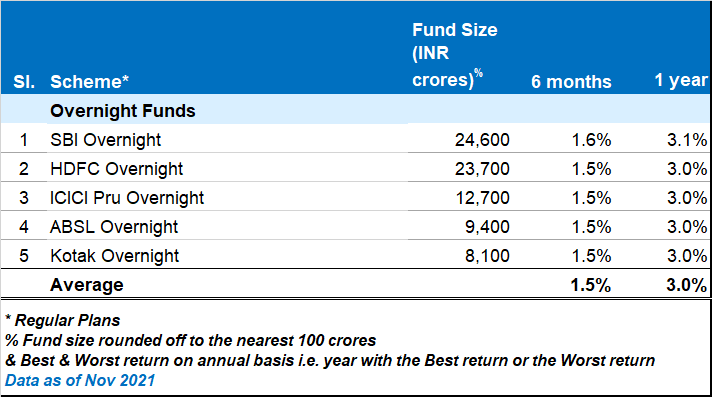

My preference in overnight funds. These funds are at par with bank deposits in risk. Their returns would vary. Sometimes it could be at par with fixed deposits. Sometimes it could be lower and closer to returns on savings account. In the last 6 months, these funds have given 1.5% return. But unlike fixed deposits, withdrawing investment is without any break costs (exit loads). You will also get the money in your account in 1 day.

So overnight funds are good to keep some money aside when you don’t know when exactly you will withdraw in the next 6 months or so. All overnight funds invest in same type of risk. So, you can pick an overnight funds by any fund house. I have given a shortlist below. These are overnight funds with at least assets under management of INR 5,000 crores.

Conclusion:

So now you have a short list of 24 funds across all key categories out of the 300 odd debt funds out there. Most of these funds have stood the test of time and delivered good returns to its investors.

I hope this article has helped you gain better clarity on which debt funds to consider for your investment. There are other articles which are there on this website or will be published soon. These articles will help you get more understanding on investment in mutual funds. I look forward to your comments and feedback.