In Part 1 of the ‘Debt Mutual Funds – All You Need to Know’ series, you would have got a good introduction to the dynamics of Debt Mutual Funds. Part 1 also gives you a good overview of the basics on Debt Mutual Funds; the key aspects and key risks.

In this Part 2 of the series we will cover the various of types of debt mutual funds. We also touch upon the suitability from an individual investor’s perspective.

Types of debt mutual funds

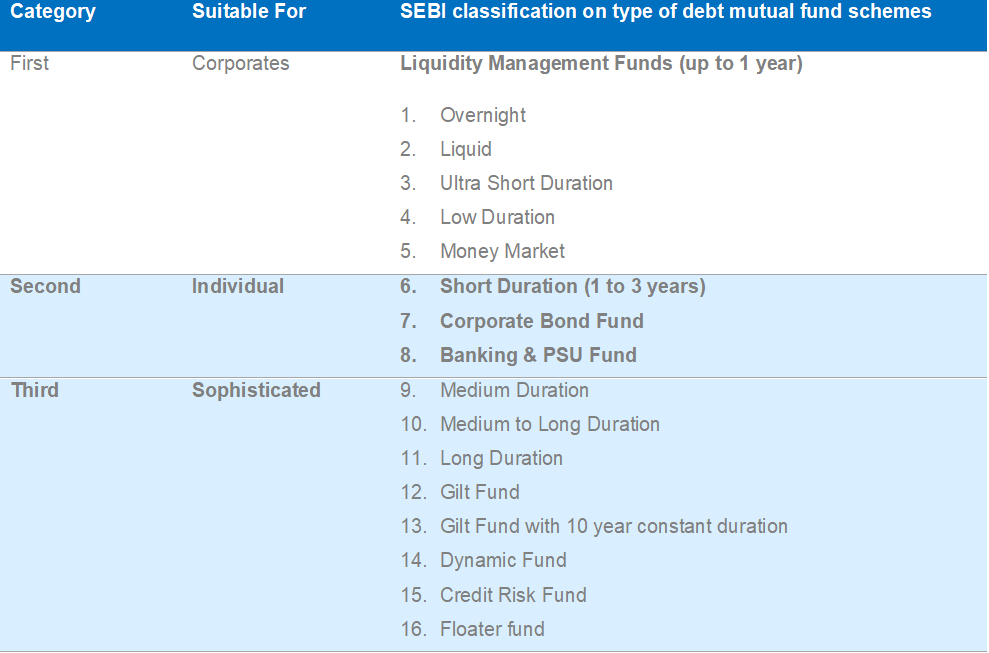

SEBI has outlined certain guidelines about classification of debt mutual funds. These guidelines classify debt funds on the basis of credit risk and interest rate risk. We have covered both these risks in detail in Part 1 of the series. If you need a refresher then go to Part 1 to understand credit and interest rate risk in detail.

As per the guidelines, there are 16 types of debt mutual fund schemes. I have summarized this in the table below. Now, 16 types of debt mutual fund schemes can look quite confusing to a layman like you and me. For a simple investor, only 3 or 4 out of these 16 types are relevant i.e. Category 2 in the table below.

I will now give a brief overview of the the 3 categories in the above table.

First Category

The overall size of debt mutual fund space would be 11.5 lakh crores or so. Out of this, over 60% fall in the up to 1 year duration bucket. These funds are predominantly used by corporates for their liquidity management. I do not consider this category to be very relevant to an individual investor like you or me.

Why ? Because:

- Fixed Deposits are safer. Generally speaking fixed deposits are safer than Liquidity Management Funds in my opinion. SEBI only mandates the duration and not the type of bonds a fund manager can invest in this category. In the past we have seen credit defaults affect liquid / money market funds. Some examples are:

- J.P.Morgan India Treasury Fund had to suspend redemptions on default by Amtek Auto.

- Taurus Liquid Fund and Taurus Ultra Short Term Bond fund got affected by default by Ballarpur Industries.

- Likewise such liquid mutual fund schemes of many mutual fund houses had exposure to IL&FS when it defaulted.

- Now this may be happening when fund managers try to chase that extra 0.5% return or so. This to me is completely unacceptable. Funds that I need in less than 12 months must be in 100% safe investments. Its as simple as that. If I have to take risk then it should be on my long term money subject to a proper financial plan and asset allocation.

- So if I need to keep surplus cash for a 6 to 12 month duration, then I would stick to the comfort of fixed deposits.

- Investors expect liquid funds to give slightly better returns than fixed deposits. It is also easier to invest and redeem from liquid funds. There is no exit load if you redeem after 7 days unlike break costs in fixed deposits. So large companies prefer liquid funds to manage their short term surplus cash. But in the case of a small individual investor like you or me, we have no such needs. For us safety is more important. We can always create fixed deposits in such a way that we don’t incur break costs if we need cash unexpectedly.

- Nonetheless if there are situations where I still need to invest in such mutual fund schemes, then I would stick to schemes of the safe fund houses. The safe fund houses are listed in the article “5 lessons for debt mutual fund investors”

Second Category

The second category consists of Short Duration Funds, Corporate Bond Fund and Banking & PSU Fund. I find this category to be most relevant to investors like us.

Why?

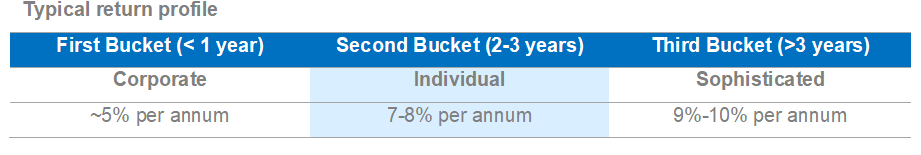

This category gives optimal risk-return. It falls in the middle of the pack in risk and return and hence I find this category well balanced. The historic return profile of these funds are given below. Of course it also boils down to which fund you invest in.

The 2 key risks in debt mutual fund are credit risk & interest rate risk.

In short duration fund, the fund manager invests in bonds with duration of 1 to 3 years. Hence these funds falls in the middle of the pack when it comes to interest rate risk.

With regard to credit risk the categories vary as given below.

- Short Duration Fund: There is no restriction on the fund manager on credit risk. The fund manager is free to invest in bonds of any Company irrespective of the credit rating. But in this category you will find many safe options, where fund managers have an excellent investment track record and predominantly invest in AAA bonds. So if you do your homework and select the right fund you can reduce the credit risk to minimal levels.

- Corporate Bond Fund: At least 80% of the total assets have to be AA+ and above

- Banking & PSU Fund: At least 80% have to banks, PSU, Public Financial Institutions and municipal bonds. These are generally the more safer category to invest in this Group.

So with regard to risk we have options to invest in safe funds with good return potential. The returns in second category are typically 2-3% higher than first category and 1-2% lower than the third category – longer duration funds.

Third Category

The funds in this category take significant interest rate risk or credit risk or both. There are phases where funds in this category has delivered double digit returns. Returns in high teens or even more than 20%; especially the long duration funds. So also returns can also be in negative double digits. But if you consider a 5 to 7 year period, the returns are 2-3% above short duration funds.

This category is more suited for sophisticated investors. Investors who have a good understanding of debt markets. You need to have a good understanding of interest rate cycle and credit risk.

Conclusion

I hope you have received a good understanding of debt mutual funds from Part 1 and Part 2 of this series. We have covered the fundamental aspects of debt mutual funds and what category of debt mutual funds to focus on.

In the concluding Part 3, we cover the lessons from the defaults that mutual fund space has seen since 2015. We will also cover how to manage risks and what investment strategy to adopt. I look forward to seeing you in Part 3.

One Reply to “Debt Mutual Funds – All You Need To Know (Series Part 2 of 3)”

Comments are closed.