Equity mutual funds are a must have in everyone’s financial portfolio. It is like salt in your cooking. Without salt, the food will be bland. Likewise, you can build a financial portfolio without equity mutual funds. But you will struggle to meet your financial goals on time.

So, it is important we take time to understand & educate ourselves on equity mutual funds. And then we should invest in equity mutual funds based on our risk appetite. But all of this is easier said, than done.

If you are not a savvy investor it is natural to feel confused with the plethora of funds to invest in. When you switch on business news or read articles, all you hear is a lot of investment mumbo jumbo. When I first started learning about equity mutual funds, I remember feeling confused and overwhelmed.

So, this article and the follow-on articles are the outcome of my trials and tribulations in this space. I hope the articles here save you countless hours and help you travel in the right direction. The 10 mins or so to go through this article should give you a good working knowledge of equity mutual funds.

I am presuming you have a basic working knowledge of mutual funds. If not, please visit AMFI Investor Corner for more information about mutual funds.

But before we get into the nuts & bolts of equity mutual funds; why are equity mutual funds so important?

Equity Mutual Funds – The Showstopper !

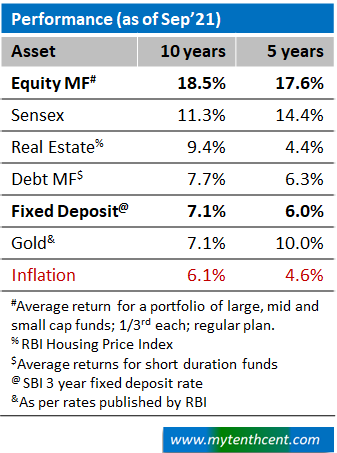

Equity mutual funds invest your funds in stock market. Over the long term, stock markets have consistently delivered robust returns. Stock market returns have beat inflation and all other asset classes.

The ultimate objective of an investment plan is to have a portfolio that can beat inflation consistently. You cannot build such a portfolio without equity mutual funds. Historically equity mutual funds have delivered minimum 4 to 5% returns over inflation. Debt products deliver 2 to 3% over inflation.

So, if you want to reach your financial goals on time you cannot do without equity mutual funds.

Now let us look at this space in detail.

Overview of equity mutual funds

As mentioned earlier, equity mutual funds invest in shares of companies listed on the stock exchanges.

The equity mutual fund industry is over 30 years old with much of the growth coming in the last 20 years. Did you know that equity mutual funds account for over 12 lakh crores which is ~40%+ of the overall mutual fund investments? Hundreds of thousands of people invest in equity mutual funds to meet their dreams & goals.

There are many types of equity mutual funds. There are over 300 mutual funds run by over 30 mutual fund (asset management) companies. So, for a beginner this can all look very complex. So, to make life simpler, SEBI, the regulator has categorized mutual funds into a few groups.

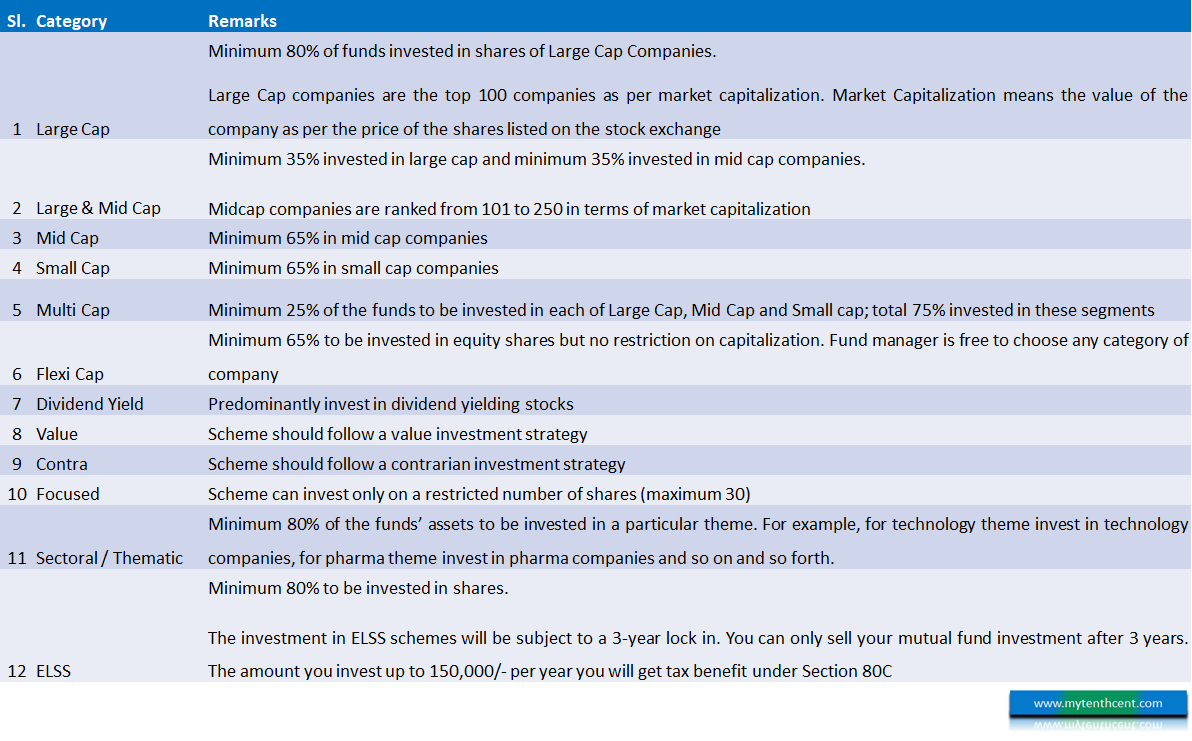

Categories Of Equity Mutual Funds

As per SEBI guidelines, equity mutual funds are of the following 12 categories.

Now the big question: how many of these categories should one focus on?

In my experience I would classify these categories into 2 Groups. Group 1 are relevant to individual investors like you and me. Group 2 is an overlap. There are some good funds in Group 2. But you can build a good equity mutual fund portfolio without the categories under Group 2.

So, Group 1 is where we will focus for the rest of the article. We will not be covering ELSS. ELSS has a specific purpose. I will cover this in another article soon. Likewise in Group 2 there are some outstanding funds and categories. We will cover this also in another article.

Mutual fund categories that matter

We have narrowed down to Group 1. Yet Group 1 has 6 categories. So, which all categories do you choose?

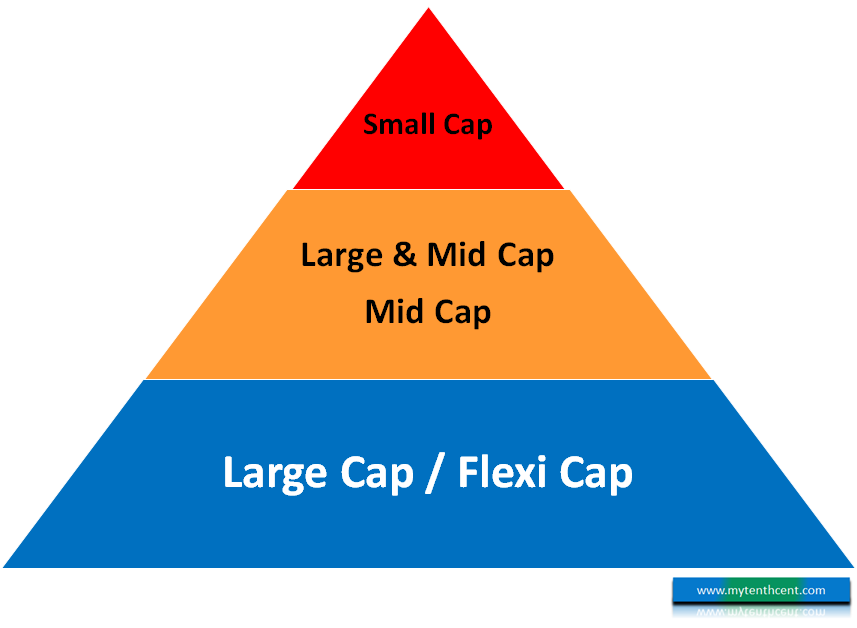

Choosing the category depends on the risk-return you can handle. If you want a stable portfolio with lesser volatility, then you focus more on large cap funds. If you can handle a higher level of fluctuations / volatility then you start moving down the chain.

In case you are wondering what cap stands for? Cap stands for Capitalization which means the market value of a company. This is share price of a company multiplied by the number of shares of the company. Large Cap means companies with large market capitalization. Small Cap means companies with small market capitalization. Simply put large and small companies.

Now, over the long-term, returns tend to be higher as you move down the capitalization chain. But you should have stomach for high degree of fluctuation. This is because today’s mid cap companies become tomorrow’s large cap companies. But at the same time not all mid cap will become large cap companies. Many perish along the way.

To illustrate, only around 7 companies have remained a constant in Sensex during the period 1986 to 2020. Sensex is an index created out of market capitalization of 30 largest listed companies in India. The rest of the companies have all churned in or churned out of the list. For example, cement major ACC used to be part of Sensex during early 2000s but not anymore. Bharti Airtel became part of Sensex in the latter half of 2000 – 2010.

So, the journey of mid cap companies is to become large cap over time and that journey leads to a lot of wealth creation. But like I said before, not all mid cap companies become large cap companies. Many of them vanish and that’s where wealth destruction happens. Hence the roller coaster ride to the top.

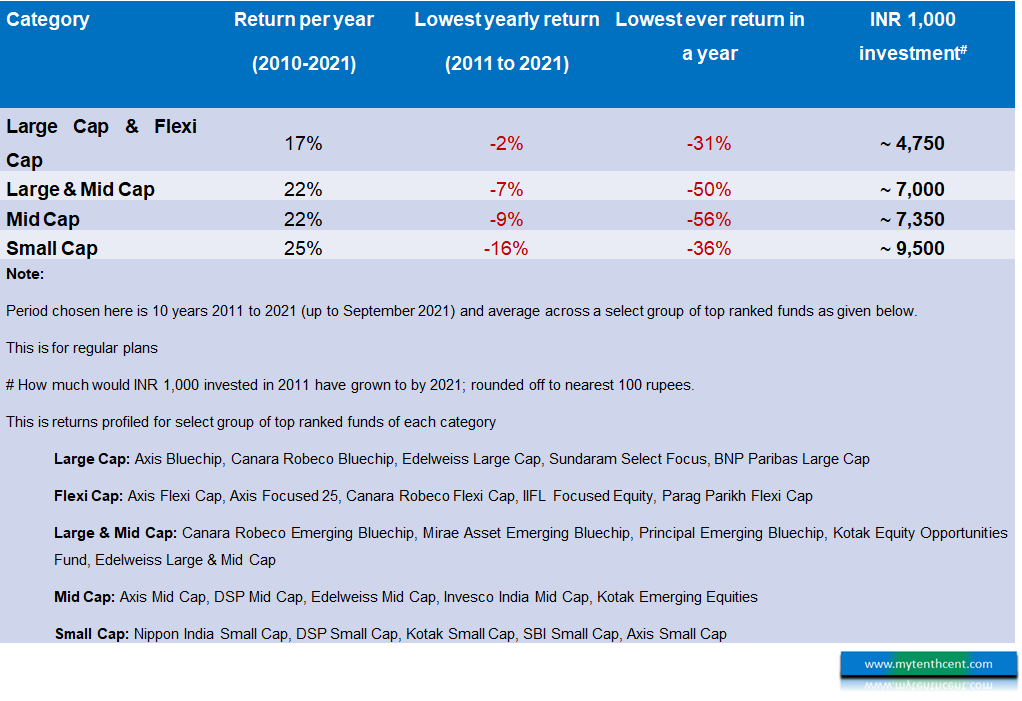

Now with that perspective, the table below shows how returns stack up for the key categories under Group 1.

We can note the following:

We can note the following:

-

As we go down the chain, risk and return go up.

-

The risk of loss in a single year can reach to around 20% – 25% in small cap. This is on the basis of last 10-year track record. The worst ever can be even close 50% as it happened during sub-prime crisis. But over the long-term wealth creation is also higher.

-

If we invest INR 1000 each in large cap and small cap. Large cap @15% returns per year and small cap @ 24% returns per year. Then at the end of 10 years INR 1000 would have grown to INR 4,100 in large cap and INR 8,500 in small cap i.e., ~2.1x.

With this background we now look at the key question – which of these 5 categories to focus on?

Category selection strategy

The category you should focus depends on your risk attitude and investment horizon. If you are looking to invest with a 2-to-3-year horizon, then you should stick with Large Cap or Flexicap Funds. The rest of the categories are for long term i.e., 5 years or higher.

Now say you are considering long term investment. The key is to work out a combination of the 5 categories. The combination should balance return and risk. The combination should give a return you are comfortable without losing a night’s sleep.

I have given 3 sample portfolios combinations below as an example. The below table shows how performance changes when you add riskier Mid Cap & Small Cap to Large Cap.

You can note that by adding 25% of the higher risk categories, you improve your overall portfolio return by 14%. But at the same time, you increase the worst-case loss increases by only ~4%. Likewise depending on your risk profile you can keep increasing the share of mid and small cap companies. This is based on historic performance of select mutual funds as given in the table earlier in this article. So now you need to sit back, analyze and decide what combination are you comfortable with?

I have often heard many friends boast about their market timing abilities. How they are able to perfectly foresee when to invest in small cap or mid cap. When to exit at the right time and move to large cap. Unfortunately for me, for most part I have been devoid of such intelligence. But what I have found to work is to have a combination and stick to it. Over the long term this gives good stable returns.

And once you have decided the combination, the only thing left is to have an investment plan. This is effectively what asset allocation is all about. And how you build a combination and target a portfolio return can include other investment categories as well.

Investment Plan : All plan and no action makes Jack a dull boy !

Investment Plan is essentially about the following questions.

-

How many funds to invest in the chosen categories?

-

Which funds to invest in the chosen categories?

-

How to invest?

-

When to invest?

Let us now delve into each of these questions.

1. How many funds?

There is no formula on how many funds to invest. I have seen some people invest in 15 to 20 funds or more. Sometimes 5 or 7 of them from the same category i.e., large cap or mid cap for example. Investing in too many funds in the same category does not help especially if that’s Large Cap or Flexi Cap. The top stocks are almost the same across all the funds in Large Cap & Flexi Cap categories. So, if you invest in too many funds you are effectively buying the market. So, your return will also be average return of the market only.

If you want to get returns better than average then you need to pick the top performing funds. But not too many of them. So now back to the question – how many funds?

I like to build a 6 to 8 fund portfolio i.e., 3 to 4 top performing funds from the low risk & 3 to 4 top performing funds from the high-risk categories. That is 3 to 4 top ranking funds from amongst Large Cap & Flexi Cap. And 3 to 4 top ranking funds from amongst Large & Mid, Mid & Small Cap.

2. Which funds to invest?

You can find the list of top performing funds in the book – Best Funds Report. This report gives a comprehensive coverage of top 5 funds in the following six categories: Large Cap, Flexi Cap, Large & Mid Cap, Mid Cap, Small Cap & ELSS. This report also gives comprehensive category analysis detailing the key dynamics of these six categories.

Once you invest, do a periodic portfolio review. Fund performance varies quite a lot depending on the fund manager and other factors. As fund managers change fund performances suffer or prosper. For example, Shreyash Devalkar joined Axis Mutual Fund around 2016. After Shreyash took over, funds such as Axis Bluechip Fund have delivered chart topping returns. The Best Funds Report also gives coverage to fund manager changes at the top ranking funds.

So, review portfolio performance periodically. At least once every year. Compare how the funds you have selected are performing versus other mutual fund schemes. If any fund shows weak performance for 2 years or more then consider exiting or reducing your exposure in that fund. You can get granular details of top performing funds at many websites. Money Control and Value Research are 2 websites which I like a lot. You can also download the Best Funds Report published by My Tenth Cent; which is updated from time to time.

3. How to invest?

Mutual Funds permit you to invest under Direct Plan or Regular Plan. Direct Plan is when you invest directly with the mutual fund through their website or app. Regular Plan is when you invest through a 3rd party such as your broker or bank.

Returns under Direct Plan is higher than Regular Plan by 0.5% to 1.0% per year. So, if you can put in the effort, then you must invest in Direct Plan. The setup effort is only one time. The benefits continue to accrue over many years.

4. When to invest?

You must have often heard the word SIP. SIP stands for Systematic Investment Plan. In simple English, SIP is to invest regularly. You decide the funds and invest a fixed sum every month.

There are so many advertisements about it. SIP has become synonymous with mutual funds. SIP is the best way to invest.

Why is this the best way?

This because stock markets are very volatile. No one can predict when the market goes up or market goes down. But when you invest every month, it should not matter whether market goes up or down. This is because you protect yourself from the risk of investing a large amount just before the market crashing. In a falling market you will continue to lower your cost through SIP. So, when market rises you will make profits faster compared to a person who has invested at the peak.

We should adopt SIP even if we have a lumpsum amount to invest. You divide the sum and invest equally over a 12-to-24-month period.

Conclusion

So, by now I hope you have got good knowledge to build a high performing mutual fund portfolio. As I have said at the beginning, equity mutual funds are a very important investment category. It should form a core part of the portfolio; at least 40-50% of the portfolio. In the long run equity mutual funds will ensure above average returns to the portfolio.

And to get good returns consistently, it boils down to a few simple steps:

1. The investment combination you adopt across large, mid and small cap funds.

2. The funds you choose.

3. Invest in a systematic manner

4. Do a portfolio review once a year

These 4 steps should help you build a high performing equity mutual fund portfolio.

You can also download our Best Funds Report which lists the top performing equity mutual funds across Group 1.

There are further articles on equity mutual funds on this website which will help you learn more. Please feel free to read and comment.