In Part 1 of this series we read about the history of gold and our unending fascination towards this metal. Gold is not just a commodity or a jewellery. Gold ultimately is a currency. A promise to hold value for future. There is nothing to suggest that there is a replacement for Gold.

So, with that foreword, is Gold a worthwhile investment?

To answer this question, we will look into the following in this article:

-

Demand for gold

-

Supply of gold

-

How gold has performed vs other investment options

-

Outlook for gold

You can alternately also watch the video and come back to print or save this article for future reference.

Demand For Gold

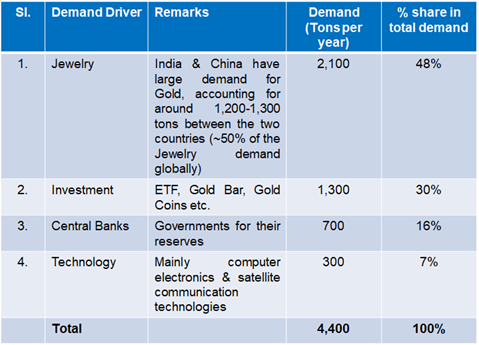

The worldwide demand for gold is around 4,000 to 4,500 tons per year. There are 4 categories of demand as shown in the table.

The jewelry demand over the last 10 years has been growing by about 0.5% per year or so. Steady but very slow. Yet Gold price has increased a lot over the last 20 years.

The jewelry demand over the last 10 years has been growing by about 0.5% per year or so. Steady but very slow. Yet Gold price has increased a lot over the last 20 years.

Why?

Answer – two words – Central Banks

You and I keep our wealth in the form of shares, deposits, real estate or something else. Whereas a country keeps its wealth in the form of gold and international currency such as Euro or Dollar among other things. We call these Foreign Reserves. Foreign reserves help stabilize an economy and its currency. India’s foreign reserves for example is around USD 600 billion as of June 2021. China has over USD 3 trillion.

It surprised me to note Central Banks have accumulated gold at a rate unseen in the last 50 years. Central Bank gold purchase went up from around 80 tons in 2010 to close to 700 tons in 2019. Russia & China have tripled their gold reserves. I suspect that tension with US is only going to make these countries to move further away from US Dollars. In short, 2010 to 2020 has been a gold buying spree by the Central Banks.

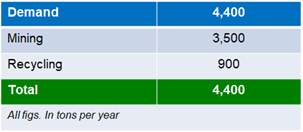

So how is this 4,000 to 4,500 tons per year demand of gold met?

Supply Of Gold

Gold is available in every continent. China, Russia, Ghana & South Africa, North American region & Americas are some of the largest producers of gold.

But as I mentioned in Part 1 of this series, we cannot manufacture gold. There is only a finite supply of gold. World wide reserves of gold estimated at 250,000 tons. Of this ~200,000 tons (80%) has already been mined and in circulation. We are currently producing only about 3,500 tons of gold per year. And the cost of extracting gold has been increasing every year.

But as I mentioned in Part 1 of this series, we cannot manufacture gold. There is only a finite supply of gold. World wide reserves of gold estimated at 250,000 tons. Of this ~200,000 tons (80%) has already been mined and in circulation. We are currently producing only about 3,500 tons of gold per year. And the cost of extracting gold has been increasing every year.

So then how is the demand of 4,000 to 4,500 tons per year of gold met?

The beauty of gold unlike other materials is, we cannot consume gold. Gold does not undergo any decay. It stays as is. So gold is one material that we can recycle. This is how gold demand is being fulfilled. Around 20% of gold demand is being met by recycling.

Gold vs Other Investment Categories

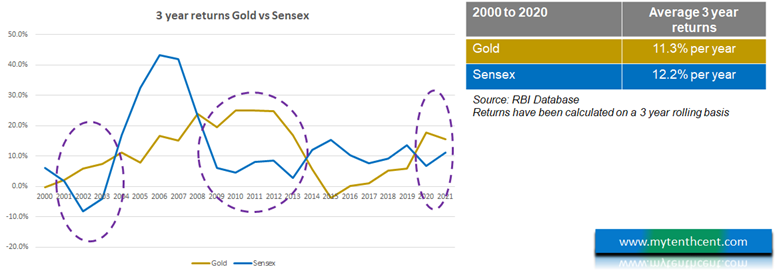

The 80’s and 90’s were very bad for gold. The gold prices fluctuated a lot. Fluctuation ranging from over (-)30% to (+)30%. If you had invested in gold, you would have probably lost money. In comparison stock markets did very well and created a lot of wealth for investors.

But towards end of 90’s something interesting happened. Something that transformed the market dynamics.

In 1999 major Central Banks of the world signed a Gold Agreement. Under this agreement the central banks agreed to control the sales of gold every year. And you would recollect that Central Banks are a very big player in the gold market. As a result of this agreement gold markets started stabilizing. The Central Bank Gold Agreements were in force up until 2019. In 2019 the agreement was not renewed as the banks felt the gold market has stabilized.

There was also another development that deepened the gold market. Early 2000’s saw the emergence of Gold ETFs. Up until that point as a gold investor you had to buy gold coins or bars and store it in a locker. So buying and selling was cumbersome. But Gold ETFs changed all that.

Gold ETFs allowed people for the first time to buy gold from the comfort of their computer. It works like a mutual fund investment. At the click of a button, you invest in a Gold ETF or Gold Mutual Fund. The ETF or Fund then buys and stores gold on your behalf and takes care of all the hassles.

These 2 developments have changed the face of gold market. As a result, 2000 to 2020 saw gold emerge as one of the top performing investments.

As you can see in the table, Gold has given a return very close to share market. Gold with an average return of 11.3% per year vs Sensex of 12.2% per year.

Gold – A Good Stabilizer

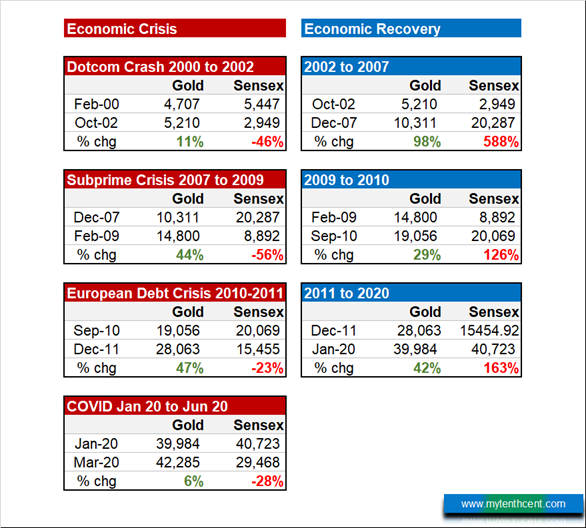

As you can see from the chart, Gold has performed better in times of economic uncertainty or crisis. That is because of the image of gold as a safe asset. Something which has kept its value for over 5,000 years. Something in times of crisis can work like a currency.

The table below shows how gold has helped stabilize returns in some of the crises in the last 20 years

So having Gold in your portfolio can stabilize the portfolio returns. When share market does poorly, gold can counterbalance.

Outlook for Gold

By now it is quite clear that gold is an important asset class and should not be cast aside. Gold has performed well in the last 20 years. But will that be the case in future? For an investment category with 5,000 year history, should we rely on the 20 years history?

Before we peek into future, let us look at the various forces affecting gold price.

A few things are crystal clear:

-

Gold supply is running out. At the current rate of extraction, we have another 15 to 20 year of gold reserves.

-

Cost of extracting gold is increasing every year. This is because mining companies have to go deeper to extract gold.

-

With political tension between US and China, there is no reason for China or Russia to go easy on buying gold.

Logically anything with high demand and limited supply, price should increase. In fact, here we are talking of supply running out. So, price should go through the roof. But that has not happened. That is because there are forces to keep the gold price in check, such as:

-

As I mentioned before, we can recycle gold. Annual demand for gold is ~4,000 to 4,500 tons against which we have ~200,000 tons of gold in circulation. So you need to only recycle 2.5% of the available gold to meet the annual gold demand. So, there is really no scenario of supply running out.

-

Jewellery demand which accounts for 50% of the gold purchases is growing at a measly 0.5%. The remaining 50% is all investment demand which can fluctuate a lot depending on market sentiments.

-

Central Banks have been a big force behind rise of gold prices in the last 20 years. Central Bank gold purchase increased from 80 tons per year in 2010 to ~700 tons per year now. Is this sustainable? At some point Central Banks’ purchase should ease off or worst Central Banks may start selling gold. This would trigger gold price to fall or taper off

-

Gold does well in terms of crisis because of the 5,000-year perception of safety in gold. As we move out of COVID into better times, people should feel more secure. As people feel more secure, they invest in share market. Thereby moving away from gold.

So overall, there are enough forces at play to keep check & balance on gold prices. That is my view. Nonetheless I see a positive outlook for gold in the medium to long term. But the journey should go through its ups and downs in the short term. And as an investor we should definitely keep a close watch on annual Central Bank gold purchases.

So How Much Investment In Gold?

By now we have established that gold is a worthwhile investment. In fact over the 20 years period 2000 to 2020, gold has given returns very close to Sensex. There is a case to argue, why not invest a lot in Gold, equal to or in replacement to Sensex.

Afterall,

-

The world gold market is ~4 times the size of Indian share market.

-

We have seen the supply challenges in gold.

-

Central banks continue to buy gold.

-

Gold prices have given good returns and relatively stable returns compared to Sensex

While all this is true, the reality is you can’t produce anything with gold. Gold stays the same. The annual jewellery demand for gold is only 5% of the gold in circulation. The rest is all speculative investment demand. And the investment demand in gold is because of its currency value. In times of crisis gold can be exchanged into money. Gold = Currency. Which as Warren Buffet has said – “Gold is a way of going long on fear”

Whereas in the case of share market you are investing in real companies. Companies which are growing and contributing to the society and economy. Hence their value increases. So, I regard share market to be better than gold. For this reason, I cannot support a scenario of gold replacing share market investments. At best gold can be a stabilizer to stabilize the portfolio. Because gold prices do well in times of crisis. So, by this measure 10-20% of the portfolio in gold should be the ideal level of investment.

Conclusion

With the 2 articles on “Is Gold a worthwhile investment?” we have covered the fundamentals of gold market. How supply is running out? Who is contributing to majority of the demand? How the behavior of Central Banks stabilized the gold market? And how we have had a good 20-year investment run in gold?

The key question is how to invest in gold? How do I choose amongst Sovereign Gold Bonds, Gold ETFs and Gold Funds? You can read about this in another article; “How To Invest In Gold”?