It seems like you have decided to invest in gold and are looking for various options. Then you have come to the right place. This article will cover in detail where to go to invest in gold.

You can alternately also watch the video and come back to print or save this article for the key reference points.

In case you are still on the fence, undecided whether to invest in gold or not, then you can go through these articles. These articles detail why gold is a worthwhile investment.

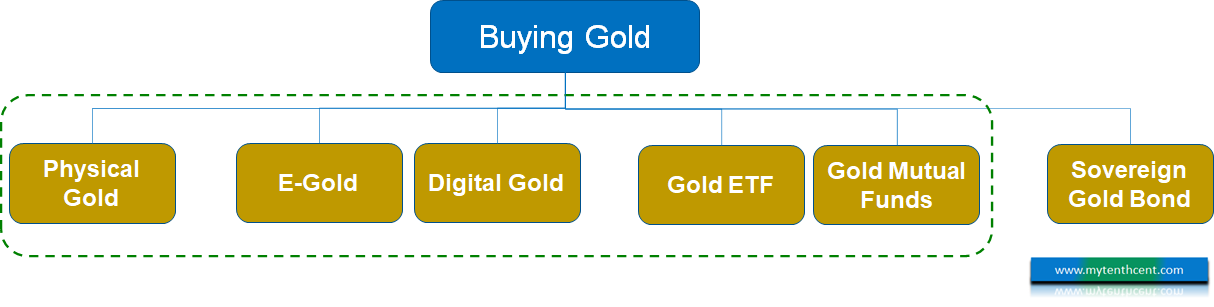

What are the options to invest ?

Now, there are 6 ways to invest in gold as shown in the chart below.

1. Physical Gold

This is the traditional way of investing in gold. You buy gold bars or coins. You can buy 24 carat pure gold coins or bars from banks or jewellers. Do note that banks can only sell gold to you but are not allowed to buy it back from you.

2. E-Gold

National Spot Exchange (NSEL) offers E-Gold. The gold you buy is held in demat form like shares. If needed, you can convert this E-Gold into physical gold as well by paying extra charges. Or you can buy and sell gold held in demat form like how you buy and sell shares online.

3. Digital Gold

Three companies offer digital gold in India: Augmont Gold, MMTC-PAMP and Digital Gold India.

You can buy gold from your mobile app such as Paytm or Google Pay or apps of these companies. It’s quite simple. You can stay invested for up to 5 years in digital format. After that either take delivery or pay charges to extend the digital holding. During the 5 years, you can also sell gold back to these companies or take delivery at extra charges.

4. Gold ETF

Mutual fund companies typically set up Gold ETF. ETF stands for Exchange Traded Fund.

The fund collects money from investors and invests in physical gold. The value of each unit of the fund being the value of the gold held by it. The fund is listed on a stock exchange such as NSE or BSE. You can then buy or sell units in the fund through your share broker or your online share trading account. The units you buy are credited into your demat account.

5. Gold Mutual Funds

Mutual fund companies which set up Gold ETF typically also set up Gold Fund of Funds on top of this. These funds function like a typical mutual fund. Instead of shares, the Gold Funds will invest in the units of the Gold ETF set up by the same mutual fund company.

This makes it easier for an investor who does not have demat account to invest in Gold ETFs. Gold Funds can be bought or sold just like your regular mutual fund investment. You can also create a SIP (Systematic Investment Plan), SWP (Systematic Withdrawal Plan) and STP (Systematic Transfer Plan) for your investments.

6. Sovereign Gold Bonds (SGB)

Sovereign Gold Bonds are issued by Government of India. Gold price at the time of issue of the bond decides the bond’s price. The bonds are for 8 years term with a lock in for 5 years. At maturity you get your money back on the basis of gold price existing at maturity. Plus, every year government will pay you 2.5% interest on the bond.

Which Option Is Better?

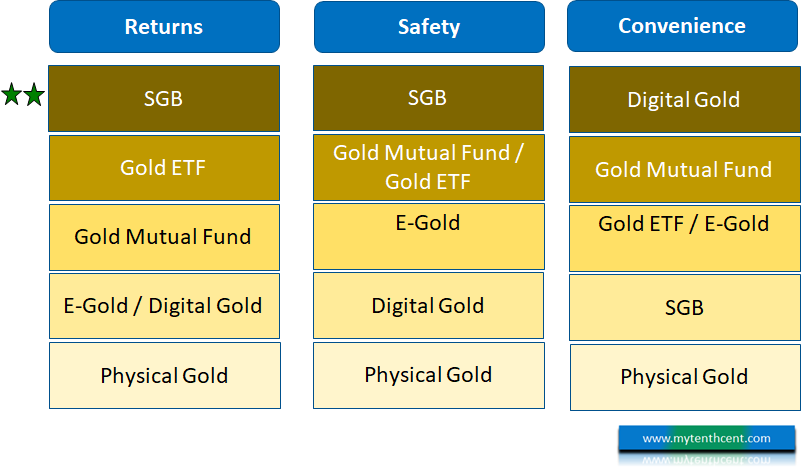

The below chart ranks the 6 options on returns, safety & convenience.

Returns:

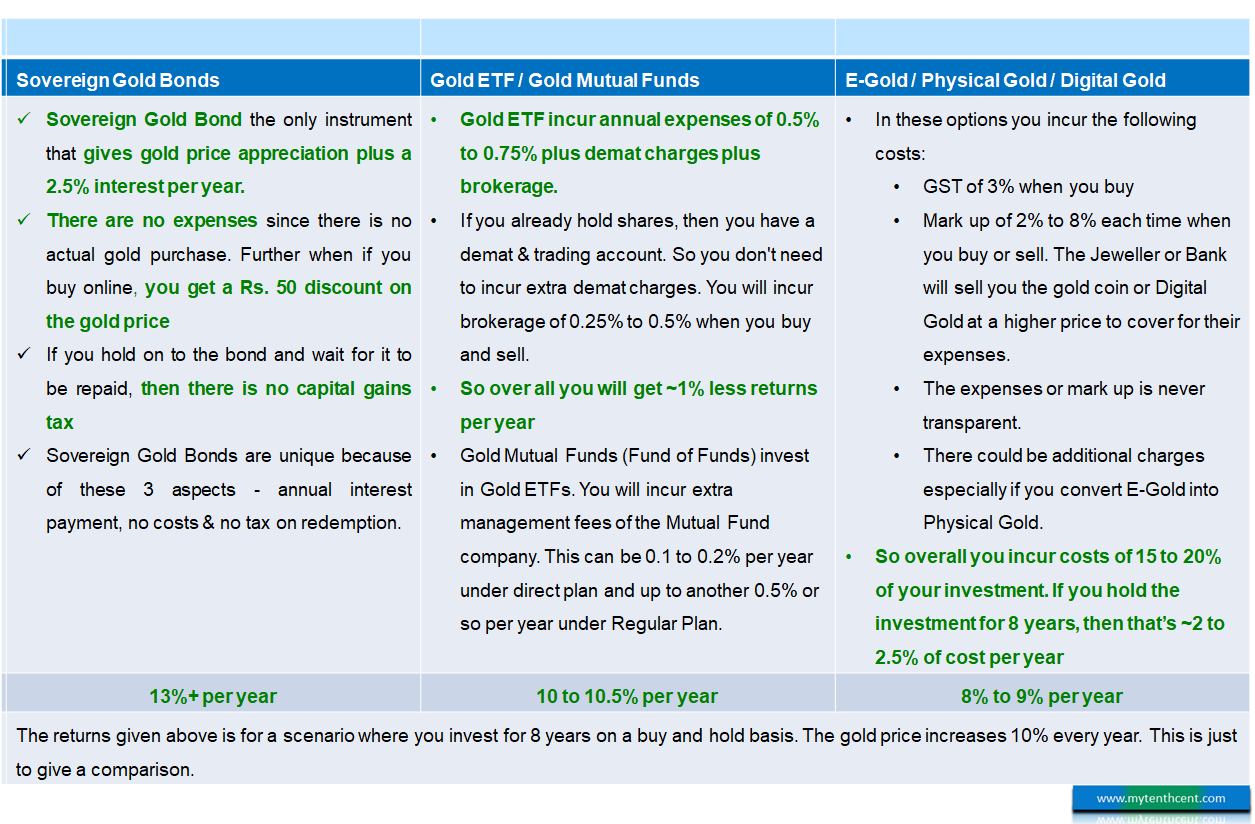

As all the options invest in the same thing i.e., gold, how much returns you get becomes a function of cost. The 6 options have different cost structures and hence returns vary.

Sovereign Gold Bonds rank the best on returns. The below table shows the costs involved in various options and how it impacts the returns.

The below table also shows the returns you can expect if you invest in each of these options. This is assuming that you invest and hold for a period of 8 years. And gold price appreciates by 10% every year. Then Sovereign Gold Bonds should return ~13%+ per year. Gold ETF / Gold Funds should return 10 to 10.5% per year and the other options 8 to 9% per year.

Safety:

When it comes to any investment there are 2 things that matter – Returns & Safety.

In the context of gold investment, safety means the safety of the underlying gold.

Sovereign Gold Bond is the safest because of two reasons (1) There is no gold involved. So, no risk of theft, fraud etc. (2) You are giving money to Government of India – the safest credit in the country.

The rest of the investment options involve gold. All these options claim to keep gold in a secure environment with insurance. Yet there are some subtle differences

-

Gold Mutual Fund / Gold ETF: The investments are under the purview of SEBI. SEBI mandates physical quarterly audit of the gold stores in warehouses. So given the strict regulatory oversight, this option has an edge over other options when it comes to safety in my view

-

E-Gold / Digital Gold:

-

E-Gold is a product offering of NSEL – National Spot Exchange. I could not find out if SEBI regulates NSEL or not.

-

Digital Gold is not under the purview of any regulator.

-

While I am not saying that absence of a regulator makes these unsafe. But a few years ago, there was a big scam with NSEL. So having a regulator does give me more comfort.

-

-

Physical Gold: The safety of physical gold is entirely upon you. Is bank locker as safe as the insured warehouse stored gold? May be or may be not. I have read about thieves breaking into vaults and bank branches. So, I think there is always a risk.

Convenience:

By convenience I mean – how easy is it to buy and sell. So, on convenience the ranking of various options is below:

1. Digital Gold:

Digital Gold is probably the easiest to buy. You can buy from your mobile app such as Paytm, Google Pay for amounts starting from Rs. 1/-.

2. Gold Mutual Fund:

If you are an investor in mutual funds, then you can buy Gold Mutual Funds quite easily. You need to follow the same process as you buy an equity mutual fund or debt mutual fund. If you are not an investor, then you will need to invest through a broker or directly with the mutual fund by creating an account, completing KYC etc.

You can find the top performing gold funds under the Best Funds section of My Tenth Cent.

3. Gold ETF / E-Gold:

-

For investment in Gold ETFs, you need a demat & trading account. You can use the demat & trading account you use for trading in shares.

-

For E-Gold you need to open a separate demat account. The demat account you open for your share purchase will not work. You can get details from NSEL website (given later in this article, below)

4. Sovereign Gold Bond:

You can buy through your online trading account or your bank savings account or through post office. Unlike the above options there are some constraints:

-

You cannot buy any time you want. RBI comes up with Gold Bond issuances from time to time in a financial year. You can only subscribe then. You can buy old bonds from secondary market (other bond holders) but that will require demat & trading account.

-

You can also sell your bonds through your demat & trading account. But the daily trading volumes for Sovereign Gold Bonds are very low. Often you may not get the best price.

-

The other option is to wait till the bond gets repaid on maturity or redeemed earlier. Redemption means sell the bond back to RBI. For this there is a lock in of 5 years. After 5 years you can exit through early redemptions. So overall not very convenient to invest and exit.

5. Physical Gold:

I find physical gold most cumbersome given you have to physically go and buy the gold. Then store it in a locker and all the hassles one has to take.

Income tax impact: Capital gains tax

1. Sovereign Gold Bonds:

-

If you hold the bond till maturity or redeem it after lock in, then no capital gains tax. For beginners, redeem means giving the bond back to the issuer i.e., Government in this case. These bonds have a 5-year lock in. After that you can choose to redeem it at each interest payment dates i.e., twice every year.

-

For more information you can find a detailed FAQ on the RBI website.

2. Gold Fund / Gold ETF / E-Gold / Digital Gold / Physical Gold:

-

-

If you hold it for less than 3 years, then no benefit. The profit is added to your taxable income

-

If you hold it for more than 3 years, then you get benefit of Long-Term Capital Gains Tax of 20% along with indexation.

-

Verdict

So out of the above 6 options, which option should you choose to invest in Gold?

Well, we invest in gold for 2 reasons:

Reason 1: As a pure investment. We don’t need the physical gold but we think gold can add value to our investment portfolio

In this case Sovereign Gold Bonds are the best option. Also, I think these bonds should be 75% of your gold portfolio. 25% you can keep in the form of Gold Mutual Fund or Gold ETF.

Why 25% in Gold Fund / Gold ETF?

-

Because this gives you the flexibility to adjust your exposure to gold depending on gold prices.

-

Sovereign Gold Bonds have lock in and restrictions on sale. You can sell in secondary through your online trading account. But the market for sovereign gold bonds is limited. Plus, you lose the capital gains tax exemption when you sell. You get that only on redemption / repayment by the Government.

-

But if there is any emergency for cash, you can always raise a loan on the back of Sovereign Gold Bond.

-

If you want greater flexibility you can increase the share of Gold Mutual Funds / Gold ETF from 25%.

Reason 2: Accumulate gold for the marriage of our children.

Gold is a very emotional investment for many of us. It is very common for parents to start accumulating gold right from the time a daughter is born. The plan is to have enough gold in time for daughter’s marriage.

But I don’t think this is a great idea that is, accumulating gold in the form of jewellery. Because in jewellery you lose a lot of money in making charges. Whereas with the investment options given above, that doesn’t happen. Whenever you actually need the gold, you can sell the investment and buy gold.

So, in this case also a combination of Sovereign Gold Bond & Gold Fund / Gold ETF is still the best way to accumulate gold.

Where to find more information on these options?

So far in this article we have looked at the various options to invest in gold. We now conclude this article with where to go to invest in gold under each of these options?

1. E-Gold:

You can find details of NSEL E-Gold product here. Procedure for investing is given here. The list of brokers with whom you can open demat account is given here. You will need to reach out to the brokers, open a demat and trading account and then buy online.

2. Digital Gold:

The links to find details on Digital Gold offered by 3 companies given here: Augmont Gold, MMTC-PAMP and Digital Gold India.

You can buy digital gold from your mobile phone through Paytm, Google Pay or PhonePe.

3.Gold ETF / Gold Mutual Fund:

Gold ETF: You can either speak to your broker or go to your online trading account.

Gold Mutual Fund: You can speak to your broker or go to the investment section in your online banking account. Alternately you can go to the website of mutual fund companies for direct investment.

4. Sovereign Gold Bonds: Any of the below:

-

Your online trading account. This should appear under IPO section or go to buy bonds section for buying in secondary

-

Speak to your bank manager

-

Go to Post Office

With this we conclude this article. I hope you have got a comprehensive review of the various options. Do leave your comments.

Look forward to the following articles that will be published soon:

1. Gold ETF vs Gold Funds a detailed comparison

2. Sovereign Gold Bond and Gold Market Cycles? How to build a portfolio of Sovereign Gold Bonds through IPO and secondary purchase?

3. How to monetize the physical gold you already have lying in your locker?