“Fortune favors not just the brave but the smart also!”

Asset Allocation is about being smart. Asset Allocation is in fact the most relevant yet understated principle of finance.

What works today need not work tomorrow. You may be planning to live off your fixed deposit returns. But tomorrow interest rates may crash. The shares that gave you 50% return need not do so in future. So, in the world of finance as is the case with life, “Uncertainty is the only certainty”. And Asset Allocation is about bringing stability and consistency to your portfolio. It is about creating a winning team with different players. Players who can cover each other’s weaknesses and collectively move forward.

So, What Is Asset Allocation?

May be the first question is what is an Asset?

An Asset is anything that can give you an income and or grow your wealth. Examples: money in your bank account or fixed deposits, shares of a company, bonds, mutual fund units, real estate, gold etc.

An Asset is anything that can give you an income and or grow your wealth. Examples: money in your bank account or fixed deposits, shares of a company, bonds, mutual fund units, real estate, gold etc.

Asset Allocation is about creating mixed portfolio of these assets. A portfolio which is stable yet gives you good returns over inflation.

An example to clarify, if you have Rs. 10,000 /- worth of investment; say Rs. 3,000/- in fixed deposit, Rs. 3,000/- in equity mutual funds, Rs. 2,000/- in gold and Rs. 2,000/- in real estate. Then your asset allocation is 30%,30%,20%,20% respectively in debt (fixed deposit), equity, real estate and gold.

Why Is Asset Allocation Important?

1. Diversification

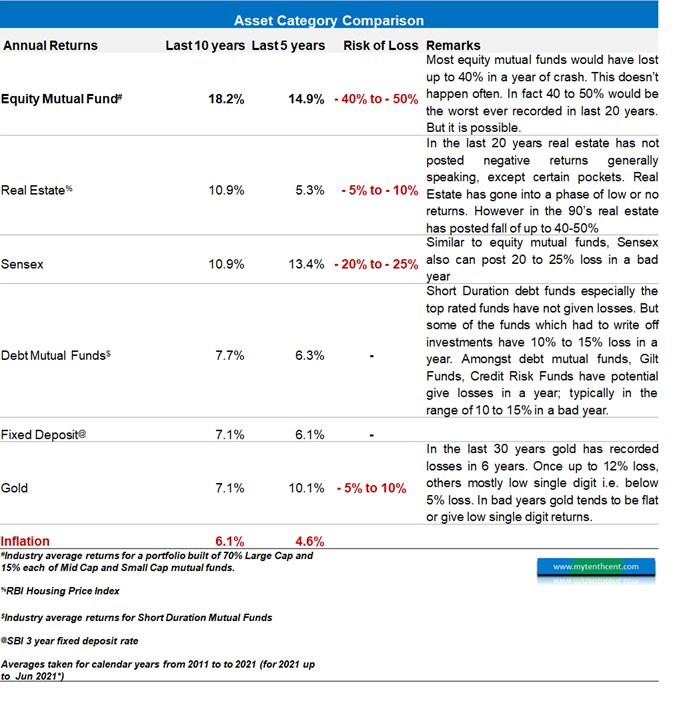

Every asset has a peculiar risk and return profile. I have given below the typical risk return profile of the common asset classes.

Fixed deposits are the safest asset class. But fixed deposits also give the lowest returns. You barely beat inflation. Equity mutual funds can give you the highest returns. But equity mutual funds have high volatility / fluctuation. The loses can also go up to 40-50% in extreme events.

Now staying on either extreme is not a sensible strategy. If you mix these assets, then you can reduce the risk of loss quite a lot. You can also increase your returns meaningfully. You won’t get the best return. But you can get a good return with low levels of risk of loss.

A portfolio where you will not have to wake up every morning worried about what is going to happen to your wealth.

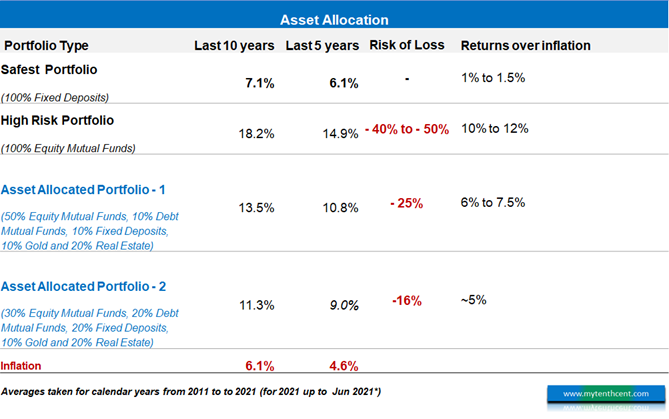

As you can see in the example given below. In the safest portfolio i.e., 100% fixed deposits you barely manage to beat inflation. On the other side with 100% equity mutual funds, while you get excellent returns you also run high risk of loss. But if you mix and match you can create something in the middle. Where risk of loss is quite acceptable and returns are healthy.

2. Asset Allocation brings clarity & discipline

Asset Allocation is not just about the proportion to invest in different assets. You should also be giving a serious consideration to:

-

What investment goals do you have?

-

When do you need the money back?

-

What is your capacity for maximum loss?

So, clarity and discipline will determine success of your investment portfolio. To quote Warren Buffet

“We don’t have to be smarter than the rest. We have to be more disciplined than the rest”

3. Asset Allocation builds patience

If you have Asset Allocation you don’t need market timing.

I have seen some of the smartest people being too focused about timing the market. They spend their time trying to figure out the best time to enter or exit their investments to maximize profit. But I have realized that growing your wealth over long term has little to do with market timing. This is because I have never seen anyone consistently beat markets.

So, instead of timing the markets, we should have a well-defined Asset Allocation. After that all we focus is Rebalancing (covered later in this article).

So, instead of timing the markets, we should have a well-defined Asset Allocation. After that all we focus is Rebalancing (covered later in this article).

4. Beat Inflation

One of the fundamental goals of an investment plan is to beat inflation. Inflation is the increase in prices of items that happen every year. Every year almost all items become more expensive. So, what you can buy for Rs. 100/- today will cost you more next year.

Inflation is a silent killer. It is like carbon monoxide poisoning. Even if you are being poisoned you do not realize because carbon monoxide has no smell. Likewise, inflation silently eats into returns of your portfolio and leaves less money in your hands to spend.

So, it’s very important for your portfolio returns to beat inflation. For example, your portfolio may give you 10% returns. But if inflation is 12%, then 10% returns is bad. Because you are losing 2% every year. So, if your investment portfolio does not give returns more than the rate of increase in prices, then you will eventually run out of money.

Nuts & Bolts Of Asset Allocation

1. List down your financial goals

You need to list down your financial aspirations. It can be things like your dream car, holiday, children’s education, retirement fund etc. Then against each of those goals put a timeline.

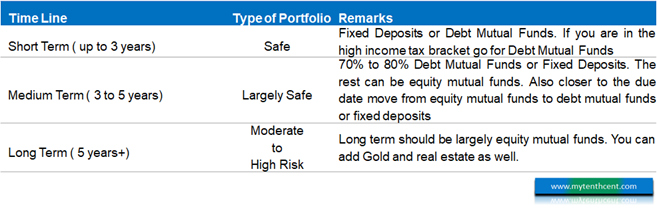

Each of the asset classes show different levels of fluctuations. Stock market / equity mutual funds for example, can be very volatile in 1-to-3-year time frame. So, if your financial goal is due in next 3 years, then you should not invest in equity mutual funds. As you can see in the adjoining table on Stock Market Cycles. The stock market cycles can range from 1 year to 5 years; with 3 year cycles being the average.

2. Match goals to assets

After listing down your goals and timeline, decide the investments to meet these goals.

You can refer the below table as a guideline.

3. Rebalancing

Rebalancing is the other side of the coin on Asset Allocation. If you don’t do rebalancing, then asset allocation remains incomplete.

Rebalancing is to ensure your portfolio at all times remain within the levels for each asset that you have decided.

For example, say you have decided 50% in fixed deposits and 50% in equity mutual funds. Then in rebalancing you would increase or decrease the share of fixed deposits or equity mutual funds, so that your portfolio remains 50:50 always.

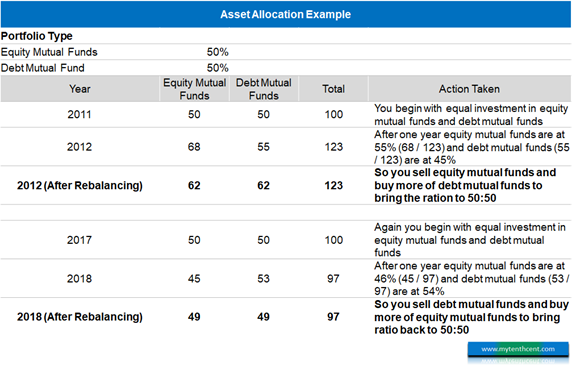

Example given in the adjoining table. In the first case stock market rallied and equity mutual funds grew from 50% share of the portfolio to 55% in one year. So, you would sell equity mutual funds and then move money into debt mutual funds.

In the second case stock market slumped. So, equity mutual funds fell. Here you would buy more equity mutual funds to bring the ratio back to 50:50

As you can see, rebalancing is the heart of asset allocation. Rebalancing ensures that you sell high and buy low. This is why you don’t need to worry about market timing. As you can see in the Asset Allocation example above. In the first case when stock market rallied you sold to bring the ratio back to 50%. This is selling at high levels. In the second case when stock markets slumped you bought more. This buying at low levels.

Why is rebalancing important?

Are you wondering why go through all the effort of rebalancing? It does look painful.

Are you wondering why go through all the effort of rebalancing? It does look painful.

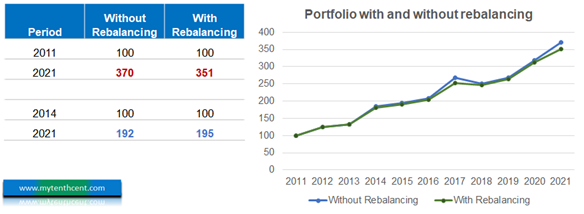

Let us look at the adjoining table. We have given 2 portfolios. Both having 50% allocation to equity mutual funds, 40% to debt mutual funds and 10% to Gold. One portfolio we invest as per this asset allocation at the beginning and leave it at that. In the other portfolio we not only invest as per allocation but also rebalance it annually. The performance for these portfolios is given across 2 time periods; 2011 to 2021 and 2014 to 2021.

You may note that, in the period 2011 to 2021, portfolio without rebalancing has done marginally better. In the period 2014 to 2021 portfolio with rebalancing as done better.

So, this example brings out a few aspects:

-

By rebalancing you do not compromise on returns as you can see in the chart. Rebalancing can in certain situations improve returns. This is especially in periods when equity mutual funds do not perform well.

-

Rebalancing is not a technique to improve returns. On the contrary rebalancing is a technique to manage the risk on your portfolio.

It is to protect extreme fluctuations in your portfolio. Here we started off with 50% allocation to equity mutual funds. If we do not rebalance, the share of equity mutual funds would have risen from 50% in 2011 to 72% in 2021. Imagine if there is COVID or sub-prime event where loss of 40 to 50% hits your portfolio. Then your overall portfolio would have lost 36% or thereabouts. Instead, if you had done rebalancing, the overall portfolio would be down by 25% only since the share of equity mutual funds would have been at 50%.

What should be the frequency of rebalancing?

I would say every 6 months if not definitely every year. You can also do rebalancing when extreme events happen. For example, when stock markets crashed due to COVID. You would notice that once every 5 years typically there is an event triggering a big crash. These are good times to buy more of equity.

It is also good to have some margin of convenience; say 5%. This means you will buy / sell and adjust portfolio only if a certain asset exceeds / falls the defined level by 5%.

For example, say you have 50:50 between fixed deposits and equity mutual funds. You will buy / sell equity mutual funds only if equity mutual fund shares crosses 45 or 55.

This is to reduce your administrative hassles. In addition, income tax liability also gets triggered when you sell. If you keep buying or selling for every % change it will be very tedious. Also, it doesn’t give much long-term benefit. Further some assets such as real estate you can’t sell or buy easily and definitely not in small lots.

What Is The Ideal Asset Allocation?

There is no formula which leads to an ideal Asset Allocation. But I have listed down some guiding principles. You can form your own Asset Allocation on the basis of these principles.

1. Goal based Asset Allocation

As outlined above under financial goals, decide the assets to invest in, on the basis of your goals and its timeline. Equity mutual funds / real estate etc. to be for medium to long term goals.

2. Age

If you are young with many years of active employment life, you can take more risks. You can also invest for the long term. You can take higher share of equity mutual funds. In the long run equity mutual funds have outpaced other asset classes on returns.

One commonly used thumb rule if “100 minus age”. That should be the share of equity mutual funds in your portfolio.

So, if you are a 60-year-old, then your exposure to equity mutual funds should not exceed 40%.

In developed markets such as US, people have been recommending 110 / 120 minus your age. This means a higher share of equity mutual funds. This is driven by low interest rates prevailing in these markets.

3. Asset types

Today as an investor you have plethora of choices to invest. These include fixed deposits, debt mutual funds, shares, equity mutual funds, real estate, REIT, commodities, gold etc.

The major categories are:

-

Debt

-

Fixed deposits with banks

-

Debt mutual funds

-

-

Equity

-

Shares; as in directly invest in share market

-

Equity mutual funds

-

-

Real Estate

-

Gold

-

Structured / Portfolio Management Service

So, you can also allocate basis a defined percentage across all or some of the above listed assets.

Way Forward

I think using a combination of above principles is a good way to move forward.

-

Identify your short term and long-term goals. Use debt mutual funds and fixed deposits for short term goals If you are in the high-income tax bracket use debt mutual funds. Fixed deposits are the least tax efficient.

-

Use the ‘100 minus Age’ principle to decide the maximum allocation to equity mutual funds.

-

In terms of, categories equity mutual funds should be the mainstay followed by debt mutual funds. Gold should be there for around 10% of the portfolio. Gold will add stability to your portfolio and do well in times of crisis.

So, a good portfolio allocation, lets call it the MyTenthCent (MTC) Portfolio, would be:

-

Equity mutual funds – 40 to 60%

-

Gold – 10%

-

Real Estate – 10% to 20%

-

Debt mutual funds – 20% to 40%

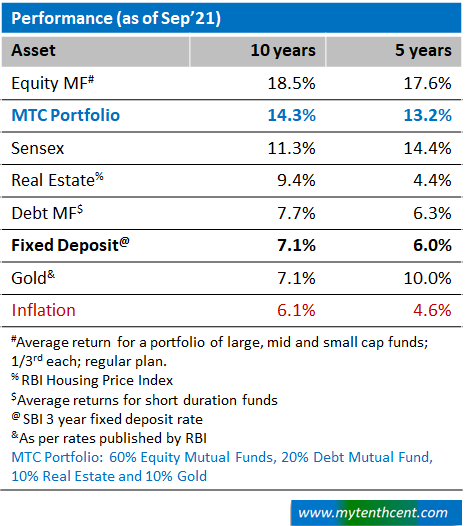

The adjoining table gives how this portfolio would have performed relative to other options.

Summary

At the end of this article if there are 2 words you should remember; that is Asset Allocation & Rebalancing.

When you invest don’t get swayed by the flavor of the season. Equity mutual funds are really in vogue these days. A lot of people I speak to want to invest in share market. In other times people sell every share and move to the safety of fixed deposits. Instead of moving in and out of assets, decide on an Asset Allocation. Then review every 6 months and rebalance your portfolio.

The following articles will give you more perspective on the major asset classes listed here.