Of all the investment options available, I find real estate the most challenging. Not because it is complex. In fact, real estate investment real estate is very simple. I find real estate challenging, because in real estate emotions always get involved.

When you buy 100 units of Axis Bluechip mutual fund, you know you are making an investment. You don’t feel any sense of attachment towards those mutual fund units. But when you invest in an apartment, you feel a sense of ownership and attachment. This leads to the confusion of whether your investment is in a Home or House?

So, this article will first cover our biases towards real estate. (This article is about residential real estate only. Not commercial real estate)

How Much Real Estate Do You Own?

When I ask this question, many people give me a number ranging from 40-50 lakhs to a few crores. Then I ask how much of this is excluding the house you stay in. Suddenly for many people the number drops to zero!

The house you stay in is not an investment. Why?

In my mind, for anything to qualify as an investment, the first rule is, can you or will you sell it?

Now you may tell me, of course if need arises, I will sell my house. The problem is with the part – ‘if need arises’. So, if need doesn’t arise you will not sell it, right? Even if the property market in your area falls, you will not consider selling your house, right? Even if you do sell it, what are your options after that? Move on rent for the rest of your life? You will still need to buy a house at some point of time. Because we all think we need a home!

So, for me the house you stay is not an investment – it is your home.

If you still insist on considering the house you stay in as an investment then the closest, I can agree is:

-

The house is an investment for your children; assuming they buy homes for themselves or

-

The value of your house over and above the number you need to buy a respectable alternate home. For example, let us assume your home is worth 2 crores in Mumbai. Now if you are okay to shift to another other place worth 1.5 crores, then the extra 50 lakhs are an investment.

So, when you calculate your net worth, I would urge you to exclude the home you stay from the calculation.

And now let’s consider real estate as an investment option. Something which you are buying with the clear intent to sell if returns are good or poor.

Real Estate Investment Is Not Sexy!

I am tired of people claiming to have made a lot of wealth from real estate. I am tired of stories of relatives investing 25 or 50 odd lakhs in early 2000 and now that property is worth crores. These stories make you think that real estate is a sure shot multi bagger. Well, nothing can be far from reality!

For example, let us say you invest 50 lakhs in an apartment in Delhi in 2000. And that 50-lakh apartment is worth 3 crores today. It looks staggering, doesn’t it? We all know how difficult it is to earn 2.5 crores. Most of us cannot even fathom that kind of a number.

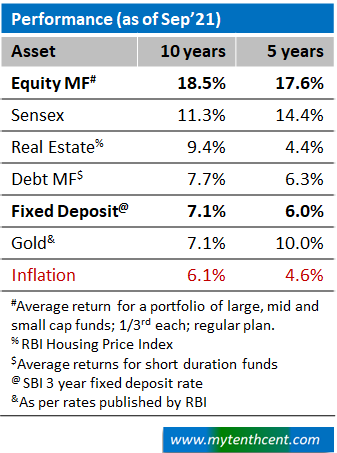

But do you realize that 50 lakhs to 3 crores is only a 9% return per year? On top of it, most likely you would have taken a home loan. If you add up the interest that you pay on the loan, then your return on property would go down to further. Also, don’t forget all the hassles that come around with real estate investment. Property taxes, maintenance & repairs, issues in selling your property, finding a tenant etc. In comparison if you had invested 50 lakhs in Sensex in 2000, it would be worth ~6.0 crores today!! a return of ~13% per year.

So, we need to stop getting carried away by these stories.

And when we think of real estate as an investment, the first thing we need to understand is real estate cycles.

Real Estate Cycles

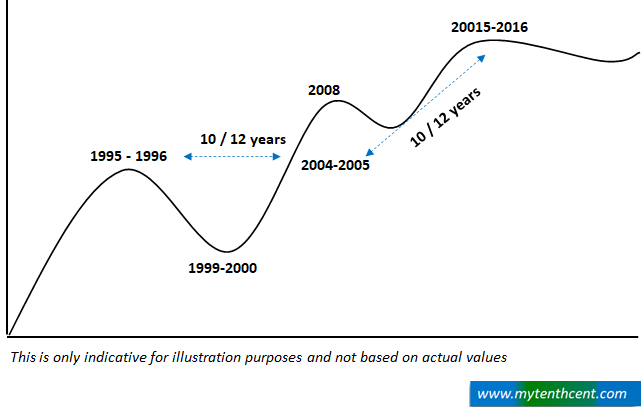

All the investment options go through a cycle of ups and downs. For example, stock market cycles are on an average 3 years. Your return would depend on when you invest in a cycle – at the top, middle or bottom. So, it is very important to understand the real estate cycles.

Real Estate market in India is still quite young. Up until 90s there was no organized real estate market in India. So, we have limited historic data on real estate property cycles; unlike US or UK.

A research study that I came across cited that property market cycles in US have typically been 18 years long. In India I haven’t found a similar study. But I would expect the Indian property market cycle to also be quite long; may be not 18 years but long nonetheless. This is because of the time it takes to create apartments; 4 to 5 years on an average. So, the market cannot immediately adjust to change in supply & demand.

Now let us look at the property cycles in India since 90s.

1. Property cycle 1990 to 2000/2001

The 1990s saw an explosive property cycle. Property prices in Nariman Point for example rose from around Rs. 5,000 psft to over Rs. 30,000 psft from 1990 to late 1995.

Liberalization and opening up of Indian economy triggered this growth. Investments from NRIs & PIOs rose manifold. But ultimately the economy couldn’t keep up. And then property market fell by 40-50% from the peaks of 1995. The property market stayed at the bottom for a long while till the next cycle started in 2001.

2. Property Cycle 2001 to 2011

The second real estate property cycle started around 2001 / 2002 and peaked in 2008. 2004 to 2008 was a phase when almost every month property prices went up. But the Great Financial Crisis of 2008 caused a pause. In fact, property prices briefly fell in 2009.

Since Indian economy was not affected much by the Great Financial Crisis, we did not see a drastic fall in property prices as it had happened in the first Property Cycle. The real estate market stayed down till 2011 end or thereabouts.

3. Property Cycle 20011 to 2021

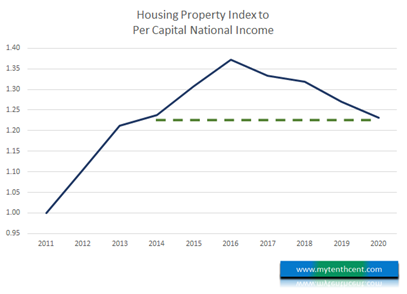

From 2012 onwards property markets started to rise again and continued to gallop till about 2015/16. As per RBI Housing Price Index, you would have got returns of around 17% per year for the 5 years from 2011 to 2016.

Indian economy then went into a hard landing with bad loan crisis of PSU Banks which began in 2015-16. Bank funding is very crucial for real estate development. With most of the PSU Banks in trouble, the bank funding into real estate development dried up. As a result, the property markets slowed down. It did not fall like in 90s. But the growth rate dropped to low single digits.

The returns dropped down to 5.5% from 2016 till 2021. In fact, RBI housing Price Index for 2020 and 2021 so far shows around 2 to 3% growth. This means that with a 5.5% return and 9% to 10% of average housing loan interest rates, you would have lost money, if you invested in 2016.

So where to from here?

As I have outlined above, Indian real estate market is still at a nascent phase. We don’t have enough data points to draw conclusions and build out trends. But if you look at the 3 property cycles, you can see that they have on an average lasted around 10 years with peak happening around the middle. So, if this pattern were to continue then we could forecast property cycles to start rallying towards a peak around 2025.

The fundamentals also seem to support this as shown below.

1) The ratio of housing price to individual income is at levels seen around 2014. This means that today real estate is more affordable compared to 2014. This ratio is not a perfect indicator of affordability. But it should give a good sense. Higher the ratio means housing prices are increasing faster than the increase in income levels.

2) New real estate projects between 2015 to 2020 have been significantly lower than 2005 to 2015. It takes 3 to 5 years for completion of a real estate project. So, you cannot create supply immediately when demand picks up.

3) Home loan interest rates are at all-time low. Further there is subsidy for first time home buyers to reduce the cost of ownership.

So, all the 3 factors above, support revival of real estate market. But COVID created further slowdown in the demand due to uncertainty over job and income levels. I think this situation should normalize in 2022 or 2023. When that happens, better affordability and lower supply should drive real estate returns.

So, does this mean you should start investing in real estate? Not yet. Not before we understand the below 2 aspects well:

-

How does real estate fare when compared to other investment options?

-

The hidden costs & pitfalls in real estate

Once we understand both the above aspects, we can take a view on whether, when and how much to invest in real estate.

Real Estate vs Other Investment Options

If you look at the last 10 years 2011 to 2021, real estate returns have been good. But if you look at the last 5 years i.e., 2016 to 2021, then real estate returns are amongst the worst.

Hence my earlier comment on being mindful of real estate cycles. As given above, the average Indian real estate cycle should run around 12 years.

If you invest with a long term, say 10 to 12 years, a return of 8-10%+ per year looks achievable based on history. But real estate can also give you 10-15% per year returns depending on your investment strategy. How? I have covered this in a separate article: Strategies to invest in Real Estate.

But before real estate investment strategy, I suggest you spend some time on Pitfalls and Challenges in Real Estate Investment

Conclusion

So, to sum up, when you look at real estate as an investment, keep emotions aside. You are buying a house not a home. Not a place where you want to stay and build a family. Once you keep emotions aside, then it is all about risks & returns. And the most important thing when it comes to real estate is property cycles.

Real Estate has long investment cycles that can run up to 10 to 12 years. So, if you invest at the wrong end, you can get stuck for a long time. And it is not easy to get in and get out. So be patient, do your homework and keep a good margin of safety.

Do go through the 2 related articles

I hope these articles give you a comprehensive view of real estate investment.