By Failing to Plan; You are Planning to Fail

We are in this amazing journey called life. How much money we have decides the quality of our journey. Yet I am shocked at how little people focus on financial planning. Most people assume that focus on earning is enough. Financial Planning will take care of itself. Well, it doesn’t work like that.

This article is a prelude to the other articles where I have covered Financial Planning in detail. In this article I have attempted to peak into some of the common biases’ when it comes to financial planning. Some of these stories may resonate with you. And if it does, I hope it leaves you with some good food for thought.

Lone Rangers:

Families where wives take no interest in financial aspects. Husbands manage everything. But why? Do people realize the consequence of wives not involved in financial planning?

Women are actually good at managing finances. They definitely have an eye for keeping expenses under control. So, managing investments is naturally the next step.

It is very important that wives are fully involved in financial planning. I have had the misfortune to see cases where husband passes away suddenly. The wife has no clue on finances. Often friends & relatives struggle to even find out where all the investments are?

So, if your family is a Lone Ranger family, then it is time to step back and ask a very important question. How prepared is your family if something happens to the person who manages the finances of the family?

Money money everywhere… not a drop to save !

Today life is becoming all about buying more and more. It doesn’t matter whether one has a need or not. People are okay to spend a whole night outside a shop to be the first to get their hands on the newly launched phone.

Now there is nothing wrong in aspiring to have the finer things in life. But one needs to ask a question, am I spending intelligently or am I an impulsive spender? Because spending and investing intelligently is at the heart of wealth creation.

Most impulsive spenders struggle to accept that they spend impulsively. In their eyes whatever they buy is a necessity. No matter how much they try, they just cannot walk out of a store without buying something. For some, this is backed by a conviction on future earning potential. There is always going to be plenty of money in future. For others, the justification is the lifestyle their society demands.

The purpose of this article is not to debate the right spending aspiration levels for each of us. But like all things in nature, there is a law of limitation i.e., careers hit glass ceiling, jobs are lost & expenses go up. Next time you pick something from the shelf, remember every small recurring expense has a large long term impact. I have covered this in detail in the article on Financial Independence – F.I.R.E; where in every Rs. 1000 of recurring monthly expense is actually equal to Rs. 300,000 to 400,000 in the long run (Rs. 3 to 4 lakhs)!

Know it all:

We often come across friends who think they know it all. They won’t put in the hard work to keep updating their knowledge. And Certified Financial Planners – they are a waste of money. They are certain that they know it all.

In spite of being in the centre of finance industry for over 15 years I am still learning new things. So, I struggle to understand the over confidence of people who know it all. As with all crafts you need to keep upgrading your financial knowledge. If you don’t do that you will be outdated. And you would pay a price through the mistakes you do in your investments.

Penny wise:

Once in a while you come across families who know the price of everything. But value? Now that’s tricky. I have seen such families taking a stingy approach to daily living expenses. But lose control when it comes to shopping. These families will cut cost in grocery but run huge credit card bills in shopping.

The long term impact is that they don’t have enough money to invest and secure their future. They are so busy trying to be penny wise that they end up being pound foolish.

Worry Pants:

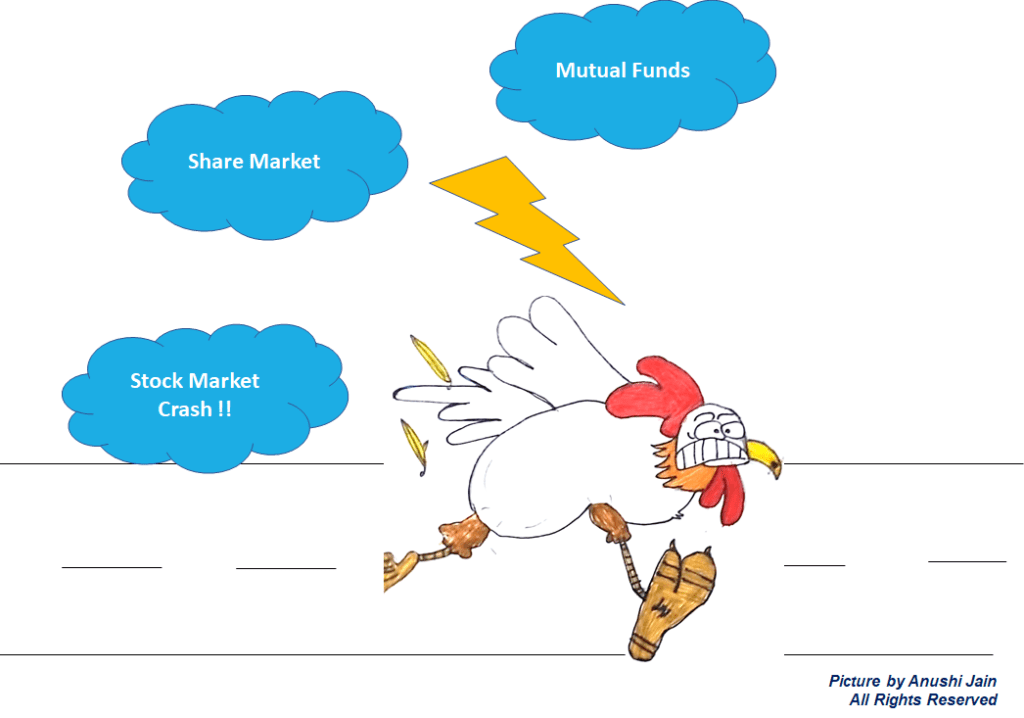

One of my favorite childhood stories is that of Chicken Little who believed the sky is Falling. When I grew up, I saw that many families are like Chicken Littles. They are afraid of the world of finance and dread investing in stock markets or mutual funds.

They think that to invest in markets is to gamble. The only sensible investment is bank deposit. These families in the long run never manage to be financially independent or wealthy. This is because bank deposits struggle to beat inflation.

If your risk appetite is low, then stick to a safe Asset Allocation. But running away from equity mutual funds is not the solution. Equity mutual funds are the most important component of wealth creation.

Dar ke aage jeet hai:

The people here are ambitious and impatient. Stories of people who create wealth overnight are a big hit with these folks. They also keep saying that ‘No Risk No Returns’. So, we have to take risk.

The problem is not with the thought ‘No Risk No Returns’. The problem is with the attitude. All risks do not translate to returns. Often there are stupid risks as well. The key is to be able to take risk intelligently and avoid stupid risk. This requires knowledge and patience. Often both are lacking in this type of people.

What now?

The purpose of these stories is to give a perspective on our biases to finance. First step is to be aware of our blind spots and work on them.

Our education curriculum does not pay any attention to financial learning. We focus on all sorts of skills to get a good job. But there is no focus on teaching what to do with the money you earn. At My Tenth Cent you would find plenty of material to enhance your financial knowledge. Do make the most of it and I would love to hear your comments.

I am not expecting everyone to be an expert in finance. But all of us should have a working knowledge of financial products. Our future depends on how well we plan our finances.

You can read more about financial planning in detail here