Financial Independence is amongst the most profound movements in finance in the last 25 odd years. If you haven’t yet heard about it, then this article will give some fascinating insights into a movement that’s becoming a cult.

If you are familiar with F.I.R.E, then read on to get a comprehensive coverage.

What is F.I.R.E?

F.I.R.E stands for Financially Independent Retire Early.

F.I.R.E is about how you achieve financial freedom so that you can retire early and don’t have to work to earn money. Some of the famous proponents of this movement have retired as early as in their 30s.

This movement can be traced back well into 1990s. One of the first books that I came across was “Your Money or Your life” by Vicki Robin and Joe Dominguez published in 1992. Today thousands of people have embraced this movement.

Some of the popular F.I.R.E proponents like Mr. Pete Adeny of Mr. Money Mustache or Sam Dogen of Financial Samurai, have followers in thousands. This Forbes article lists the 9 most popular blogs on F.I.R.E; if you want to learn more.

Why should I read about F.I.R.E?

If you are happy with your job and earning well; you might have tuned out the moment you heard retirement. I mean why should you bother read it? Retirement is no where even remotely in the horizon.

Well, the more I read about this subject I realized F.I.R.E is not actually about retirement. It’s about a way of life. It’s about freedom and finding time to pursue the things you love and give you true happiness.

Now, if you are someone who has worked for 15 to 20 years, then there is a lot of chance you take to F.I.R.E like fish to water. After working all these years, one often tends to get disillusioned with all the nonsense that one has to put up at work. How managers and organizations say something and do something else. In fact, many of us work in organizations with really toxic work culture. But we are often stuck in the race because we have no option and have bills to pay.

So irrespective of where you fall in the spectrum, F.I.R.E is relevant to every one of us. It is a concept we should embrace and actively pursue. No matter when we exit the rat race, F.I.R.E will ensure we are ready for quitting.

Safe Withdrawal Rate (SWR): The Core Of F.I.R.E

I did a small survey on how much money does one need to be Financially Independent? And the survey surprised me. Most of the people were either clue less or gave impossible retirement portfolio numbers.

But if you are serious about F.I.R.E, the first thing you need to understand is Safe Withdrawal Rate.

Safe Withdrawal Rate is that percentage of your wealth that you can withdraw every year to cover your expenses. And yet your wealth will last your lifetime.

Let me illustrate with an example. Let us assume you have accumulated INR 1 crores (10 million) in investments. You are thinking of retiring. Let us also assume your monthly expenses are INR 25,000 per month i.e., annual expense of INR 300,000. This works out to 3% of 1 crore. So, your Withdrawal Rate is 3%.

Now the question is whether 3% is a Safe Withdrawal Rate or not?

What Withdrawal Rate is Safe?

A common rule of thumb is 4% or 25 times your annual expenses. This is backed by a scientific study popularly known as the Trinity Study.

In 1998, three professors of finance at Trinity University undertook a study to determine Safe Withdrawal Rates. They took a portfolio comprising of stocks & bonds covering a period from 1926 to 1998. The result of the study was a Safe Withdrawal Rate of 4% of the investments. If the withdrawal rate is 4% or below then your investment will last a 30-year retirement 95% of the times.

And if you reduce the Safe Withdrawal Rate to 3% or 3.5%, then the investment will last 30-year retirement close to 100% of the times.

So, 3% to 4% of our investments as annual expenses is the magic number to pursue. Alternately 3% means 33 times and 4% means 25 times of your annual expenses. So, 25 to 33 times your annual expenses.

For example, if your monthly expenses are Rs. 50,000. Then annual expenses work out to Rs. 600,000. So, 25 times to 33 times means, Rs. 1.5 crores to ~Rs. 2.0 crores

Road to achieving SWR:

So now that we know the target amount, the question is how do we achieve it? We can break down the path towards financial independence into a few simple steps.

Level 0: Warm Up

The first step is to list down your assets, liabilities, goals, income & expenses. I always remember Peter Drucker’s quote:

“What gets measured gets managed”

Level 1: Foundation

The next step is to get to a point where you have monthly surplus. On a regular basis every month your expenses are less than your income.

If you are struggling with savings, then some of the below tips can help you.

-

Relook at your expenses

-

As the cricket analogy goes, every run saved is a run scored. Try to cut down your expenses so that you can increase your savings rate.

-

Even a saving of Rs. 1,000 per month makes a difference. I am not talking about one-off expense; but Rs. 1,000 out of routine recurring expenses. For every Rs. 1,000 per month shaved off on a permanent basis means you need Rs. 300,000 to 400,000 less in your retirement kitty. Rs. 1,000 per month means Rs. 12,000 per year. 25 to 33 times of Rs. 12,000 works out to Rs. 300,000 to Rs. 400,000. So, when you save Rs. 1,000/- you are actually saving Rs. 300,000 to 400,000.

-

Now the question to answer is, do we pay attention to the true impact while increasing our eat outs & shopping? The point is not to be a miser but to be aware of the true impact of our life style choices. May be there is a better & cheaper alternative. There is a very interesting article by Mr. Money Mustache on value of ten dollars.

-

-

Review the loans you have taken

-

Reduce high-cost loans. For example, credit card loans or personal loans.

-

Any loan which is >10% interest rate in today’s scenario is a high-cost debt!

-

By replacing high-cost loans with low-cost debt you increase savings. For example, if you have loans on your credit cards, replace that by taking a top up loan on your property or loans from friends & family. If you have some fixed deposits or investments, take loan against that. If there is no cheaper avenue to raise a loan, then simply just cut your expenses and reduce the high-cost debt.

-

-

Increase your income

-

Sit down and make plans to increase your income.

-

Be it asking for a raise in your current job or finding a better job or starting a side business. There are plenty of articles on how to start a side business to enhance your current income.

-

Once you have managed to get monthly savings, build an emergency fund. This fund should be 3 to 6 months of your monthly expenses. This fund will take care of any unforeseen situation like job loss.

Last thing in foundation phase is insurance. If you don’t have adequate life and health insurance, then get that sorted.

Once you have these basics sorted, the foundation is more or less in place.

Level 2: Journey to Financial Independence

Once you have achieved monthly surplus, regularly save & invest every month. The goal is to reach 4% SWR or 25 times your annual expenses; after keeping money aside for your financial goals. Financial goals can be a house or your children’s education or whatever else.

Earning well and saving well is not enough. It is also important that you invest your savings well. Most people are busy chasing careers and salary hikes. But they do not pay even a fraction of the same attention to their investments.

The reality is you have to be as passionate about growing your wealth as you are about earning it. One has to spend time to grow the tree. There are plenty of articles here on My Tenth Cent which can help you in your journey.

If I may leave a few thoughts:

If I may leave a few thoughts:

-

To achieve your F.I.R.E goals faster you need to take time out on investing your savings. If you can’t then hire a trustworthy investment advisor.

-

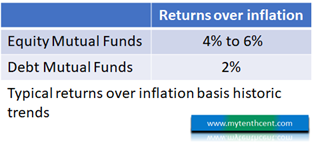

The portfolio should have equity mutual funds. Equities have historically delivered 4 to 6 % returns over inflation. With debt alone you cannot reach your F.I.R.E goals.

-

If you are planning to retire early, then your retirement portfolio will need to have around 50% of equity mutual funds.

Only then the portfolio can carry through a 35-to-40-year retirement horizon.

Level 3: Financial Independence and after

Have you achieved the 25 times multiple? Then congratulations! you have reached a zone where you don’t need to take nonsense from your boss anymore.

Have you achieved the 25 times multiple? Then congratulations! you have reached a zone where you don’t need to take nonsense from your boss anymore.

What now? As I have said at the beginning, F.I.R.E is not about retiring and lazing around drinking Pina Coladas. You can do it for a year or two but doing it for ever, doesn’t make sense. That can be a very depressing way to live.

You should now find something you are truly passionate about. Something which gives purpose to life and makes it worth getting up every day. There is a good chance you will also earn money pursuing the passion. So go into a semi-retirement where you don’t really have to withdraw much from your retirement kitty.

But if you truly desire to never work again and want to laze around, then you should consider some more aspects.

-

Do you have adequate health insurance? Health inflation in India is very high. Even if you have health insurance, keep some more money aside to cover any medical emergency.

-

The absolutely safe zone in SWR is 3% or 33 times as per the various studies. So may be its worthwhile to chug along till you increase the kitty from 25 times to 33 times. You don’t need to work full time. You can go into semi-retirement and work till your kitty grows to cover 33 times your annual expenses.

These are the key F.I.R.E principles in summation. Before wrapping up the article, let’s also have a quick look at some of the pitfalls.

Pitfalls of F.I.R.E

F.I.R.E movement also has its fair share of critics. So, to give a complete picture I will outline some of the pitfalls you need to be aware of.

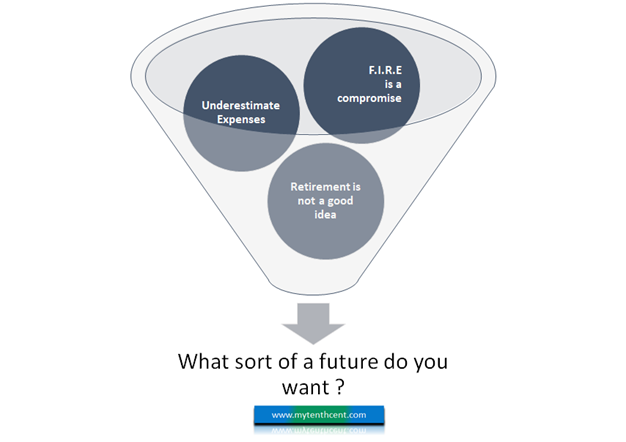

F.I.R.E is a compromise:

Aspiring financial independence is difficult. It requires some hard work with regard to planning, controlling expenses & lifestyle. With so much of consumerism around us it’s very hard to control the mania to enhance your lifestyle.

The easy availability of loans makes us more and more debt ridden. Many are trapped in the EMI cycle of spending and paying off the loans. More and more of today’s generation operate with consume today & pay later philosophy. That does not work to get to F.I.R.E

So, for many pursuing F.I.R.E look like a compromise. I have heard people quote, why would you want to live in poverty today and not enjoy your best years so you can retire early. Honestly there is nothing wrong in this perspective. Its ultimately boils down to what you want and how you derive the balance.

Nonetheless, if financial independence is not one of your goals, then you are never getting off the treadmill. At some point your job is going to suck. So, if you don’t  plan for financial independence then you are going to be in trouble.

plan for financial independence then you are going to be in trouble.

2.Underestimating expenses:

Once you get hooked onto F.I.R.E, it’s quite likely you pursue it actively. Many achieve financial independence in 10 to 20 years. If you do that congratulations. But don’t jump off the bandwagon just as yet.

Stress test your calculations. Have you missed out anything? Health Care, Income Tax impact etc. So do leave some buffer in your calculations.

Nonetheless, 4% or 25 times is a good number to start off. Because 4% rule assumes you never get any income post quitting your job. It assumes no alternate income; no inheritance and you will not be able to cut expenses if required. Mr. Money Mustache has covered this nice article on why 4% is good number.

3. Retirement is not a good idea:

I completely agree. A lot of the material that you find on internet about F.I.R.E, talk about a life of early retirement and relaxation. I am not a big fan of this lifestyle.

As I have said earlier, goal is to be financially independent to pursue what you love. That I find absolutely aspirational. Being out there enjoying some kind of work, solving problems, meeting new people and having new experiences. It is these things that make life worthwhile.

So, if you ask me F.I.R.E is about Financial Independence and not retirement.

4. Do these numbers work from India context?

The Trinity study looks at 30-year retirement period starting from 1926 onwards on a rolling basis till 1998. This is based on a portfolio comprising of 50% equity and 50% long term bonds.

Thought we don’t have financial markets data before 1990, there is no reason to assume these results won’t work for India.

Let us look at the 30-year period 1990 to 2020 and a portfolio of 50% equity mutual funds & 50% debt mutual funds. On an average this portfolio would return 4 to 4.5% over inflation on a 5- or 10-year rolling basis. It is a generally accepted thumb rule that equity markets should give 4 to 6% over inflation over long term and debt markets 2 to 3%. So it is possible to create a portfolio which yields 4%+ over inflation.

Way Forward

If you have heard about F.I.R.E for the first time, then this article is likely to leave you with mixed feelings. A part of you will want it and will love the concept. Another part of you will be anxious and apprehensive to act on it. What if you quit and run out of money? This is normal. All I can say is there are plenty of materials out there on this subject. Get yourself educated and take a call.

I conclude this article with the hope that this article has given you a good perspective on Financial Independence and F.I.R.E movement. I also would like to hope that you have found some inspiration to pursue financial independence seriously.

And if you are truly inspired, do take a print and stick it somewhere you can see to help you stay on the course.

Wish you all the best.