Real Estate is one of the biggest investment categories worldwide. You may or may not buy shares or mutual funds or gold. But you will definitely have bought or considered buying a house.

The allure of real estate is very strong. Real Estate creates an emotional connect with you; a sense of attachment and ownership. Unlike mutual funds, the house also becomes a status symbol. Not to mention the pride one feels in owning a property. All these make a heady cocktail mix that you can miss the pitfalls when investing in real estate.

In another article, I have covered the emotional conflicts in real estate investment. Why it’s important to understand the property cycles and what sort of returns can you expect? But a real estate investment strategy can be only complete, once you factor in the pitfalls.

Pitfalls In Real Estate Investment

The pitfalls in real estate investment, remind me of the story of Medusa. There are many takes on the Greek myth of Medusa. My take is that of a seductress with fatal beauty that if you look into her eyes you turn into stone. When we invest in Real Estate, we are so attracted by the investment that we miss the following pitfalls.

1. Hidden Costs:

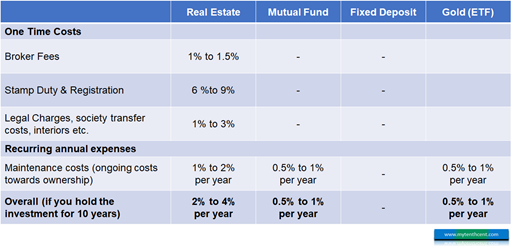

Real Estate has high levels of transaction costs. People often forget to budget this, in their investment decision. Some of the costs being:

-

Stamp Duty & Registration Charges: Around 6 to 9% of the property value when you buy.

-

Broker Fees:

Real Estate purchase often involve a broker. Brokers charge 1 to 1.5% per transaction. So, you have to shell out 1.5% to 3% of your investment towards broker fees.

-

Legal charges, Society Transfer Charges: All apartments

are usually a part a housing society. Housing societies charge a transfer fee. While this varies from city to city, but one can assume 0.15% to 0.25%

are usually a part a housing society. Housing societies charge a transfer fee. While this varies from city to city, but one can assume 0.15% to 0.25%

- Interior expense: Even when you buy an apartment as an investment, you would need to let it out on rent to cover your recurring costs. In this case you will need to incur some interior decoration expenses. At the very least wardrobe, modular kitchen, water heaters and such. There is no thumb rule around this as it depends on the extent each person wants to do up the interiors of the flat. But at the very least you should budget 1 to 3% of the property cost for this.

- Ongoing recurring expenses: Society maintenance charges, property tax, repairs, wealth tax so on and so forth. These expenses kick in when construction is complete and apartment is in your hands. Repair expenses are hard to predict. A leakage or seepage can end up costing upwards of a lakh to repair. Real estate experts recommend to budget around 1% per year for maintenance expenses of the property. If it’s a luxury apartment then this expense will be higher.

So, on the whole you can consider around 8% to 12% of the property value as one-time charges. And let’s, say you hold the real estate investment for 10 years; a typical real estate cycle. So, 10% works out to around 1% per year of the cost of your property. Add to this we incur another 1 to 2% as ongoing recurring cost of ownership of the property. So, in total around 2 to 3% of your property value per year goes towards expenses. That is around 20 to 25% of the investment towards expenses over a 10-year period. This is the highest in comparison to other investment options.

2. Rent out drama!

One way to invest in Real Estate is to enter an under-construction project and sell as soon as its complete. No hassles about finding a tenant.

But it is not easy to plan like this. Often you would be selling after a few years of completion. Then you should rent the property out. If you want to get good returns, you have no choice but to rent out the house. As mentioned above, the hidden costs of the apartment purchase are at least 2% per year. So, you have to rent out to cover the costs.

But that doesn’t mean you are going to make lots of money renting out your house. I see many elderly people wanting to invest in an apartment to get regular rent. They believe this gives them a pension like income stream. But it doesn’t work like that.

Never invest in a real estate property to get rental income. That’s the worst way to look at real estate investment. Invest in real estate property to get capital appreciation. Rent is to cover the operating costs and slightly improve your returns. Why?

Because India has one of the lowest rental rates in the world. You don’t get more than 3 to 4% of your property value as rent every year. This would just about cover the operating expenses and the one-time costs you incur in buying a property. After deducting these expenses, you don’t get more than 1 to 2% in your pocket. Hence it is not worth investing in Real Estate just for rentals.

Of course, while you factor in renting out your property, do remember than a bad tenant can create a lot of issues. Something which you cannot estimate or quantify the impact on an excel sheet.

3. Apartments are easy to sell only in TV advertisements!

If you have sold an apartment in your life, you will understand what I mean by this point.

One can never estimate the amount of work required to sell an apartment. Selling mutual fund units or shares or Gold ETF is a breeze. Just a click of a button. But selling a property is days and weeks of effort. Meeting with many potential buyers, long negotiations and weeks of effort in documentation.

So, a thumb rule, never get into a real estate property unless you can get 10% p.a. of returns i.e., your property should double in 7 years! Because below this return the effort is just not worth it.

The moment you put a filter like this, a lot of the calls from real estate brokers will stop making sense!

4. Income Tax Laws

Speaking of hassles, income tax treatment of Real Estate is no piece of cake. If you sell an equity mutual fund you pay 10% tax and move on. But in a real estate investment, you have the options of paying tax on your profit or investing in special Bonds or investing in a new property. There are specific rules around each of these. In simple words you need help of a Chartered Accountant to navigate through the tax laws!

5. Real Estate – A bite too much!

In other investment products, you can buy in small lots based on your appetite. You can start with as low as a few hundred rupees. Mid way if you realize you made a mistake you can easily course correct.

But it does not work like that in Real Estate. The smallest ticket will run into tens of lakhs of rupees if not crores.

So, course correction is not easy my friend. You better get it right; else you would end up spending a lot of time and money fixing your mistake.

To belabor the point, if you had invested at the top of a real estate cycle such as 1995 or 2014-15, you would have been stuck for a long time. 8 to 10 years or more with sub optimal returns.

5. Real Estate is no diversification buddy!

If economy crashes, stock markets crash. Guess what happens to real estate market? They also crash! No rocket science here. So don’t invest in real estate to make your portfolio safer from stock market crashes.

What The hell! Should I Invest In Real Estate Or Not?

By now you must be wondering, this guy has just been listing all the problems about Real Estate. Should you even bother investing in Real Estate or not?

Well…… I will not suggest to invest or otherwise. That is for you to make your mind up. I will however cover two strategies for real estate investment in another article listed in the end. But I would say this much, Real Estate is one of the largest investment categories worldwide. Real estate will never go out of vogue, at least not till the time we all continue to have children! India is a country with housing shortage and will remain so for a long time to come.

Conclusion

So, to sum up, if you want to invest in Real Estate:

-

Take a deep breath, next time you hear about that exciting Real Estate investment opportunity. Don’t rush to invest in an area because a new mall or road or metro station or even airport is coming up. Remember that in our country nothing gets completed on time. Bigger the infrastructure project longer the delay. And you can get caught on the wrong side of real estate cycle.

-

Be mindful of the property market cycles. RBI publishes Housing Price Index. It is a good proxy to estimate where you are in a property cycle.

-

Mistakes are very costly in real estate investment. So, take your time, do your research. Real Estate is about diligence and patience. In case of mutual funds, you have to keep tracking and adjusting your portfolio all the time. You can’t do that in real estate. Real Estate is about making the right investment and then sitting patiently for it grow and give you returns. So, it’s important to get your call right.

-

And lastly invest in a real estate project where your money can double in 7 years. Else it’s just not worth the hassle. And this is not easy. This requires something to grow by 10% per year. The RBI Housing Price index is showing only 5% returns for the last 7 years. But with homework and investing in the right projects it is not impossible either.

If you want to read more about real estate investment strategies then follow on the article: Strategies for Investment in Real Estate

are usually a part a housing society. Housing societies charge a transfer fee. While this varies from city to city, but one can assume 0.15% to 0.25%

are usually a part a housing society. Housing societies charge a transfer fee. While this varies from city to city, but one can assume 0.15% to 0.25%

One Reply to “Pitfalls And Challenges In Real Estate Investment”

Comments are closed.