“Without strategy, execution is aimless. Without execution, strategy is useless.”

Morris Chang (Taiwanese Billionaire)

Real estate is a very unique type of investment. You can have a low-risk investment with returns near to fixed deposits. You can also have an investment with returns in the 100% zone; multi-baggers as I call it. This article will delve into the nuances of these two approaches.

When you buy a property, you must be clear on what you want? Because if you are not clear on your strategy and exit plan, then you will end up having low returns by default!

And before that we should be clear about:

Building Blocks Of The Strategy

The following aspects are the building blocks for real estate investment strategies.

-

Real Estate is a cyclical business with real estate cycles running for 10-12 years.

-

History supports a long term of 8 to 10% per year. This is based on RBI Housing Price Index. Also, these returns are possible if you invest on the right side of the property cycle and have the patience to hold on. If you look at RBI Housing Price Index, the average return between 2012-2016 was 17% per year. But the average return between 2017 to 2021 dropped down to 5% per year with returns in 2020 & 2021 dropping down to 2-3%.

-

Keep your emotions aside. This is an investment. You are buying a house not a home! You should invest with a clear exit plan.

-

Build a margin of safety. You will never be able to buy at the price you want. You will end up paying higher. You will never be able to sell at the time or price you want. So, buy at rates with some buffers built in. And negotiate hard.

Now with these basic aspects refreshed, let’s look at the two approaches to real estate investment.

Lazy Zone: Fixed Deposit Like Real Estate Investment

What is this strategy?

-

As the name goes, this is a low-risk investment strategy. You invest in completed houses in well developed areas and then hold on to it.

-

The rentals on the house will cover the ongoing expenses and put 0.5% to 1% per year in your pocket. The rest of the returns to come up from property appreciation; which happens with overall market appreciation.

What returns can we expect?

What returns can we expect?

-

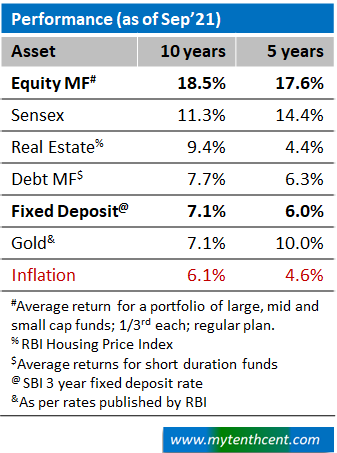

The returns you should expect is around 5 to 7% per year depending on the real estate property market. If it is a weak market such as 2016 to 2021, you would get an average of around 5% per year.

-

But over long term, say 10-15 years I expect the returns to go up to 8 to 10% on an average after deducting expenses. This is keeping in mind the historic trends.

Who is strategy suitable for?

-

This strategy is suitable for those who wish to diversify from fixed deposits or debt mutual funds. You don’t want to keep all your eggs in one basket. And you like the touch & feel of a real asset.

-

Further over long-term real estate should give higher returns than fixed deposit or debt mutual funds. If you look at the ten-year period from 2011 to 2021, real estate returns are around 9 to 10% per year vs debt mutual funds at around 8% per year. This assumes that you would rent out your property to cover the one time and recurring annual expenses of about 2 to 3% per year. If you don’t then real estate returns would go down to 6% to 7% zone.

What are the risks?

-

By nature, this is a low-risk strategy. You do not run any completion risk i.e., the property not getting completed and being stuck.

-

If you ensure Title and legal documents are clear, then that risk is also eliminated

-

The only risks you run are a bad tenant and overall slowdown in real estate market.

What nuances to keep in mind?

-

In this strategy it is better not to take home loans. If home loan rates are in the range of 8 -10% per year, then you returns will suffer. If property is growing at 7-8% and interest rates are at 8 to 10%, then you are losing money. Unless you plan to invest the money kept for loan prepayment in high growth investments such as equity mutual funds.

-

Also, you must have the time and patience to deal with all the hassles of real estate investment. These being letting out your property, monthly maintenance and other expenses & repairs etc.

-

If you are hard pressed for time and have a hectic life, then stay away from this strategy.

Multi-bagger Zone: How To Double Your Money In 5 Years?

No, I haven’t lost my bearings. If you have the risk appetite then it is possible to create an outstanding investment in real estate.

What is this strategy?

-

Doubling your money in 5 years, means your investment need to grow by ~15% per year for 5 years.

-

Now when you look at real estate investment, what are your options?

-

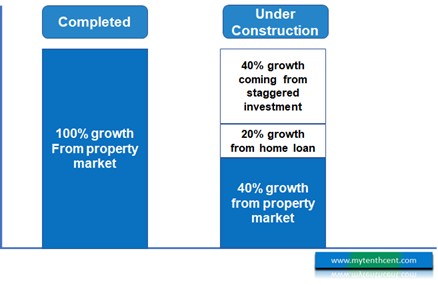

Option 1: Invest in a completed property

-

In this

case, the only way you can double your money is if the real estate market is in a bull run and also doubles i.e., grows by 100%.

case, the only way you can double your money is if the real estate market is in a bull run and also doubles i.e., grows by 100%. -

How realistic is this? In 2011 to 2016; 5 years; RBI Property Index grew by 120%. So yes, doubled. But 2016 to 2021, the growth was only 30%.

-

So, it really depends on the vagaries of the market; not something you can plan for.

-

Further even if the overall property market grows, the micro market where you invest may or may not grow as much.

-

And as I have mentioned in my earlier articles, in real estate, margin of error is very less. It is not easy to get in and get out of real estate investments. So, you cannot afford to make mistakes.

-

-

Option 2: Invest in under construction properties

-

Now this is a game changer. How? Let’s take an example.

-

Let us assume you invest in an under-construction property. The construction period is 4 years, with a payment plan of 30%,40%,20% and 10% each of the 4 years equally per month.

-

Further you take a home loan of up to 85% at an interest rate of 8% per year.

-

You sell the property at the end of 5 years upon completion.

-

Now in this case the property market need not grow by 100% like Option 1. Property market needs to grow by only around 40% over 5 years for you to double your money. This translates to a yearly growth rate of ~7%+ in the overall real estate markets. Now this is not unrealistic, isn’t it?

-

In the last 5 years 2016 to 2021, the absolute returns of RBI Property Index have been around 30%. So, if you choose the area to invest wisely 40% that you need can be aspired.

Also bear in mind under construction properties tend to go at a discount of 5 to 10% to completed properties.

-

-

How does this strategy work?

In case you are wondering how can I get 100% growth when the property market grows only 40%? Where is that 60% (100% minus 40%) difference coming from?

In case you are wondering how can I get 100% growth when the property market grows only 40%? Where is that 60% (100% minus 40%) difference coming from?

-

You don’t invest all the money upfront. The investment is staggered over 4 years. So, you are getting the benefit of property market growth in these 4 years without investing all your money. This factor alone makes up for 40% out of the 60% difference!

-

Home loan accounts for the remaining 20%.

-

For the 4 years of construction phase, the loan is in Pre-Emi phase. You only pay the interest.

-

When you sell at the end of 5 years your total investment is 15% of property cost + interest for 5 years + principal repayment for 1 year. If you let out your property for a year, then lesser.

-

As a result, you invest far lower than in a completed property. In a completed property held for 5 years your investment would be 100%. If you had taken home loan to buy the completed property, your investment would still be around 60% of the property cost. This is considering 15% your own contribution + EMI payments over 5 years. But in under construction property, your investment would be around 35 to 40% only.

-

-

So, in simple English is in spite of investing far lower you get to see the full returns.

What returns can we expect?

-

As mentioned above, the target goal of this strategy is to double your money in 5 years i.e., a return of 15% per year.

-

This requires real estate property market to grow by 7%+ per year or ~40% over 5 years. But if property market grows by only 30% over 5 years then you would still get 50 to 60% return on your investment i.e. 10% per year return.

-

Below these levels it is not worth it. Because below these levels, things get tricky. If the property markets grow by only 2 or 3% per year as it is happening now, you won’t make any meaningful return. When this happens, the home loan that you take to boost your returns will become a bane. With home loan interest rates at 8% per year and if property market grows only 5%, you lose money.

Who is strategy suitable for?

-

You must have a higher risk appetite for starters. The real estate investment you make under this strategy should not be more than 10% – 20% of your overall net worth. Unless of course you love casinos and are willing to bet all in.

-

This strategy requires you to do a proper study of the real estate market and developers. If you are unable to get meaningful insights into why a particular market can grow 40 to 50% in 5 years, then stay away from this strategy.

What are the risks?

-

Completion Risk. You are depending on the developer to complete the property and on time. Over the last 5 years, we have seen plenty of examples of how projects have got stuck. If that happens then it is no longer about returns but your capital is at stake then!

-

Market risk. If the real estate market does not grow by at least 6 to 7% per year, then you won’t make any meaningful return. In fact your returns will dip below the returns on fixed deposit. So be sure whatever you reason to invest, is sound.

What nuances to keep in mind?

-

This entire strategy is based on a 5-year holding period i.e., you enter at construction phase

and exit at completion. What happens if you hold on for more period?

and exit at completion. What happens if you hold on for more period?

-

Let us assume that the property market continues to grow 7%+ per year but instead of 5 years, you hold on for 7 or 10 years?

-

If you do this then your returns start falling drastically.

Why?

-

Because of the EMI burden. For every extra year you hold on, the interest & principal payment keeps increasing. That means your capital invested in the property keeps going up.

-

So, if the property market continues to grow at the same rate, then your per year returns will keep coming down. The 15% per year return will keep falling down to 10% per year zone if you hold on for 10 years. This is assuming you would rent out the property to cover the expenses once property is completed

So, to summarize multi-bagger is a very focused strategy. You need to be very clear on the risk you are undertaking and have the ability to manage the risk when things go off track. If you are not able to do that then go for low-risk strategy or avoid real estate all together and focus on equity mutual funds + debt + gold.

So where to from here?

As I said at the beginning, “Without strategy, execution is aimless and without execution, strategy is useless”

So when it comes to real estate investment it is very important to have a clear idea on both strategy & execution.

Are you looking at safe zone investment or a multi-bagger? If you are investing in a completed property then don’t expect a multi-bagger return. If you are investing for multi-bagger returns, then you will have to take risk. Do your homework properly. You should ask the following questions:

-

What makes you think that the property will appreciate 25% in the next 5 years? Is there any infrastructure like a new road or airport or metro coming up?

-

If there is an infrastructure coming up, will it get completed on time? What happens if the infrastructure gets delayed? We live in a country where all projects get delayed. Is it better to enter now or wait till you have certainty? Property market is slow and goes through 10–12-year cycle. If you are investing at the bottom, it should be okay to wait 1 to 2 years to get certainty on the timeline of the infrastructure project. If you are investing at the top, then it’s definitely better to wait.

-

How is the builder? Does the builder have a proven track record of delivering on time? Check how many projects has the developer delivered in the past and the delay pattern. A lot of information is available online in various forums.

-

Even if the builder delivers projects on time, how is he financially doing? Many developers have got into trouble. Ask around your friends in the banking industry or real estate sector to get a view on this.

-

If you get bad reports about a developer, then don’t go further. The multi-bagger strategy works only if the project is completed on time!

Real estate is a high maintenance investment. So, take your time and study your investment options properly.

You can download the Real Estate Investment Evaluator tool that would be published on this website soon. This tool will allow you do a whole host of investment analyses such as:

-

Whether to invest in completed or under construction? How would the returns vary?

-

What happens if your interest rates on your home loan goes up?

-

What happens if you increase or decrease the loan amount?

-

The tool also has a check list which can help you form an informed decision on your investment.

I hope this article has given you a different perspective to a very commonly discussed investment topic.

When it comes to investment options, I don’t think any investment category is per se good or bad. What really matters is the return you want and the risk you are prepared to take. And once you have taken the risk do you have a system in place to manage & monitor the risk. Monitor how your assumptions have panned out and have a back-up plan in place should things go wrong. It is ultimately about margin of safety. It is having a Plan B to your Plan A that makes an investment good or bad.

case, the only way you can double your money is if the real estate market is in a bull run and also doubles i.e., grows by 100%.

case, the only way you can double your money is if the real estate market is in a bull run and also doubles i.e., grows by 100%. and exit at completion. What happens if you hold on for more period?

and exit at completion. What happens if you hold on for more period?